Iraq's Oil: The Greatest Prize Of All

Posted by Big Gav in iraq, iraq oil law, resource wars

I am saddened that it is politically inconvenient to acknowledge what everyone knows: the Iraq war is largely about oil - Alan Greenspan (2007)

The Guardian had an interesting article recently on the auction of 40 billion barrels of Iraqi oil reserves.

The biggest ever sale of oil assets will take place today, when the Iraqi government puts 40bn barrels of recoverable reserves up for offer in London. BP, Shell and ExxonMobil are all expected to attend a meeting at the Park Lane Hotel in Mayfair with the Iraqi oil minister, Hussein al-Shahristani.

Access is being given to eight fields, representing about 40% of the Middle Eastern nation's reserves, at a time when the country remains under occupation by US and British forces. Two smaller agreements have already been signed with Shell and the China National Petroleum Corporation, but today's sale will ignite arguments over whether the overthrow of Saddam Hussein was a "war for oil" that is now to be consummated by western multinationals seizing control of strategic Iraqi reserves.

The subject of Iraqi oil is one which has fascinated me for a number of years, so in this post I'll outline why I believe that Iraq probably has the world's largest oil reserves - or, as Daniel Yergin once said of the middle east, it is "the greatest single prize in all history" (echoing a similar statement by George Kennan at the end of world war 2).

The Control Of Oil

What people need to hear, loud and clear, is that we're running out of energy in America - George W Bush (2001)

A few years ago I came across a book from the 1970's about the oil industry called "The Control Of Oil". The book was written by John M Blair, an antitrust economist who worked for the Federal Trade Commission and the Senate Subcommittee on Antitrust and Monopoly, paying particular attention to the oil industry. The book draws on his experience and the hearings conducted by Senator Frank Church's Subcommittee on Multinational Corporations into the industry in the wake of the oil price shocks of the early 1970s.

A reviewer at Amazon did a good job of concisely summarising the book, in particular noting that there was no supply shock in the years that the price shock occurred:

"The Control of Oil," By Dr. John M. Blair is a brilliant look at how the price of crude oil was determined by giant petroleum companies (the seven sisters) and a dozen members of the Organization of Petroleum Exporting Countries (OPEC). Blair traces the history of these controls and explains how they recklessly triggered the 1970's global energy crisis.

This 1976 publication is a classic. To this end, Blair spent thirty-two years in the federal government. He started in 1938 as an author of monographs for pre-World War II investigations. Early on, he made his name focusing on the sizable concentrations of economic power in the oil industry by the Rockefeller family and family foundation.

Afterwards he spent nearly a decade with the Federal Trade Commission as an Assistant Chief Economist and finally Blair spent fourteen years as Chief Economist of the Senate Subcommittee on Anti-trust and Monopoly. What makes this book truly special is the author's enormous access to critical government information.

Blair describes the oil industry's principal tax preferences, which worked to the advantage of the major companies and against smaller nonintegrated companies that could have favorably altered the availability and price of oil to consumers. The author also goes into great detail to reveal how the "Arab Embargo" that set the stage for the massive oil price explosion of October 1973 - January 1974 had little impact on supply and that in reality there was no crude oil shortfall. Ultimately, Blair emphasizes the need for developing alternate energy sources in the future.

The introductory section in the book includes an analysis of the lead up to the original Hubberts Peak (of US oil production) and presents a range of estimates for world ultimately recoverable oil reserves - all around the 2 trillion barrel mark still predicted by the ASPO. Unfortunately the author discounted the main oil peak (at that time predicted for around 2000) on the basis that, at the time, this was a full generation away, and that therefore the world will have moved onto a more sustainable and efficient energy model (he uses hydrogen as an example) and will have abandoned gas guzzling cars etc.

I had a good chuckle at that section.

The bulk of the book is divided into 3 parts - "The Control of Foreign Oil", "The Control of Domestic Oil" and "Erosion and Explosion".

The first part looks at the history of how the oil majors (known as "the seven sisters" at the time - Exxon, Mobil, SoCal, Texaco, Gulf, BP and Shell) manoeuvred to control the majority of the non-communist world's oil reserves, particularly in the middle east. In particular this involves examining the structure of the oil companies created in Iraq, Saudi Arabia, Kuwait and Iran, and the measures taken to ensure that the local governments followed the instructions of the oil companies, including the overthrow in the 1950's of Iran's democratically elected government of Mohammed Mossadeq when he tried to nationalise the oil industry.

Middle east oil was important to the oil majors in the days when there was far more supply available than required by the industrial economies of the time. The oil majors put in place a series of byzantine arrangements (such as the Achnacarry agreement) in order to restrict production and control the distribution ("marketing") of oil in order to maintain their desired profit margins and minimise the possibility of competition arising.

There is also a brief section on the attempt of the Italian state owned energy companies under Enrico Mattei to break the hold of the majors on oil refining and distribution in Italy. Mattei was successful for a while, but eventually he began expanding his enterprises outside and elsewhere in Europe and action was taken. Political pressure was applied to put a stop to this (with Exxon even donating money to the Italian Communist party - not a common move by American multinationals during the cold war - in order to get them to support moves against Mattei). Mattei eventually died in a mysterious plane crash, which put an end to the entire experiment.

The second section of the book looks at how oil production and distribution were controlled within the United States. The role of Rockefeller's "Standard Oil" monopoly is only briefly touched on, but the behaviour of the collection of oil companies that resulted from the breakup this organisation is examined at some length, along with the role of the Texas Railroad Commission in restricting production within the US (prorationing), and the import controls put in place by the government to restrict imports of foreign oil. The astounding range of tax breaks and transfers of money from the US Treasury to the oil companies is also examined at some length.

Part 3 discusses the events in the years leading up to the oil price shocks of 1973 and 1974. The oil price shocks were enabled by a range of factors - the arrival of Hubbert's peak for US oil production, and what Blair calls "The Evisceration of the Libyan Independents" (where Colonel Gaddafi's coup somehow resulted in the independent oil producers operating in Libya, who had made major dents in both the oil price and the market share of the majors, suddenly being effectively wiped out) and "The Crippling of the Private Branders" which describes how the majors throttled the supply of oil to the independent petrol retailing chains and refineries in the US.

By the time 1973 arrived, the majors were in a position where they once again controlled the oil coming into the US and the retailing of petrol and other refined oil products. Towards the end of the year, the Arab oil "embargo" was put in place and the price of oil sky-rocketed - as did the profit margins of the oil majors. In spite of the widely held belief that this event restricted the flow of crude, in actual fact the total oil production for the year grew at the customary 10% over the previous year (oil production growth was carefully managed for many years to achieve approximately 10% growth in supply each year - which made for a very smooth "Hubbert curve" up to the mid-1970's) - the "embargo" was preceded by a rapid rise in production for the preceding 6 months.

Some examination of the winers and losers in the whole episode is made - with the oil majors and the OPEC governments coming out ahead the most, the US in general doing fairly well thanks to petro-dollar recycling, but the developing world getting financially wiped out (which much of it still hasn't recovered from).

The History of Iraq's Oil

The Middle East with two thirds of the world's oil and the lowest cost, is still where the prize ultimately lies, even though companies are anxious for greeter access there, progress continues to be slow - Dick Cheney (1999)

The British captured Iraq from the Ottoman Empire during world war 1. A country-wide insurrection began in 1920, and the British spent the next 10 years fighting a "war of pacification" against the insurgents (some things never change) and making heavy use of the fledgling RAF to do so. Winston Churchill was reputedly responsible for the use of gas against the Kurds in Iraq's north during this period, making him the role model for Saddam's later atrocities, though it is not clear if this actually happened (for that matter, Saddam also disputed that he was responsible for the Halabja massacre).

Britain granted independence to Iraq in 1932, leaving the country in the hands of a Sunni monarchy (though it maintained large permanent military bases in the country and maintained an indirect form of colonial control). During world war 2 the country was re-occupied as the British sought to protect the Iraqi oil fields free from German (and American) aspirations, with control being handed back to the monarchy after the war.

In 1958, the monarchy was overthrown by a nationalist military coup. After a period of instability, the Baath party seized power in 1968 and managed to consolidate control over the country, putting down a communist rebellion in the south and a Kurdish rebellion in the north. The 1972, Iraq nationalised its oil reserves and pushed the previous owners of the IPC out of the country.

Saddam Hussein formally assumed control in 1979, embarking on an 8 year war with Iran initially and shortly afterwards invading Kuwait (after accusing them of stealing Iraqi oil) and setting off the first Gulf War. A significant amount of Iraqi oil infrastructure was damaged during Saddam's wars, and the post-war sanctions restricted Iraqi oil production and exports. The second Gulf War and the insurgency that followed caused further damage.

Iraq currently produces around 2.2 million barrels of oil a day - 300,000 b/d less than its average before the US invasion in 2003. Iraq pumped as much as 3.7m b/d before the war with Iran in 1979.

The most interesting (and to this post, relevant) part of "The Control Of Oil" was on Iraq. Iraq was used as the "swing producer" in the middle east for a long period of time, with production throttled back and forth as demand required (Saudi Arabia and Iran were less amenable to this sort of manipulation).

The history of the Iraq Petroleum Company (IPC - a joint venture of BP, Shell and some of the american oil majors, along with "Mr Five per Cent", Calouste Gulbenkian) was examined in some detail, in particular the suppression of oil discoveries in Iraq in order to avoid the Iraqi government forcing the IPC to develop newly discovered oil fields. The chapter concerned can be found here:

Although its original concession of March 14, 1925 covered all of Iraq, the Iraq Petroleum Co., under the ownership of BP (23.75%), Shell (23.75%), CFP (23.75%), Exxon (11.85%), Mobil (11.85%), and Gulbenkian (5.0%), limited its production to fields constituting only one-half of 1 percent of the country’s total area. During the Great Depression, the world was awash with oil and greater output from Iraq would simply have driven the price down to even lower levels. Delaying tactics were employed not only in actual drilling and development, but also in conducting negotiations on such matters as pipeline rights-of-way. While such tactics ensured the limitation of supply, they were not without their dangers. If the Iraqi government learned that IPC was neither actively seeking new fields not exploiting proved and productive areas, it might withdraw or narrow IPC’s concession, or worse, award it to some independent willing and anxious to maximize production.

Suppression of Discoveries

From almost the beginning of its operations IPC not only suppressed production in Iraq (as well as in nearby lands) but went to considerable lengths to conceal that fact from the Iraqi government.

Of the many concession areas exclusively preempted by IPC, none was rapidly developed. IPC had held the area east of the Tigris River in the Mosul and Baghdad vilayets since1931, and by 1950 the only developed field was Kirkuk. Qatar is another illustration of “sitting on” a concession. Fearful that the area would fall to outside interests, Anglo-Iranian in 1932 obtained a two-year exclusive license for a geological examination of this peninsula. These exploration rights were expanded into a concession in 1935, and in 1936 were given to IPC under the terms of the Red Line Agreement. BP and Shell, however, were not anxious to develop more production in the Persian Gulf because of the effect this would have upon production in Iran. Although Mobil wanted more crude from the Persian Gulf, drilling did not start until three years and five months after the signing of the geological survey. A productive well was completed in 1939, and a few others were drilled after the war began; but in 1941, an official (Mr. Sellers) wrote: “….. as there is excess of petroleum products available from AIOC and Cal-Tex in Persian Gulf, it is obvious productive wells in Qatar will not be expedited at present time.” Commercial production in substantial quantities did not begin until 1950- eighteen years after the first exploration of the area. ...

World War II interrupted the operations of IPC in most of its concessions, and political disturbances handicapped its activities since that time. Yet even after allowing for these difficulties, in 1948 production in Iran was seven times larger than in Iraq, while in 1936 production in Iran was a little more than double that in Iraq. In Saudi Arabia commercial production did not begin until 1938, but by 1948 it was almost six times the production of Iraq.

The restrictive policies of the Iraq Petroleum Company during its early years have been summarized as follows:

Following the discovery of oil in Iraq in October, 1927, these three groups (BP, Shell, and Exxon-Mobil) employed a variety of methods to retard developments in Iraq and prolong the period before the entry of Iraq oil into world markets. Among the tactics used to retard the developments of Iraq oil were the requests for an extension of time in which to make the selection plots for IPC’s exclusive exploitation, the delays in constructing a pipeline, the practice of preempting concessions for the sole purpose of preventing them form falling into other hands, the deliberate reductions in drilling and development work, and the drilling of shallow holes without any intention of finding oil.

Restrictive policies were continued even after a pipeline was completed, for in 1935, IPC’s production was a shut back several hundred thousand tons. Moreover, for a time, a sales coordinating committee was established to work out a “common policy regarding the sale of Iraq oil.” Again in 1938 and 1939, the Big Three opposed any “enlargement of the pipeline and the corresponding increase in production” on the ground that additional production would upset the world oil market. Although the Big Three eventually conceded to the demands of the French (CFP) for some expansion, no action was taken until after World War II.

While the restriction of Iraqi production during the 1930’s had its roots in the generally depressed economic conditions of the time, the continued curtailment of Iraq’s output after World War II stemmed from different causes. With the development of Saudi Arabia and Kuwait, the US firms- which owned 100 percent of the former and 50 percent of the latter- gained large-scale sources of supply that were far more attractive to them than Iraq, where their ownership interest was only 23.75 percent. A later complication was the emergence of Libya as an important and largely uncontrollable source of Middle East countries. To the question of whether Libyan output could be accommodated within the limits of the overall growth rate Page answered, “Of course, with Iraq down.” Indeed, keeping Iraq “down” was the only means by which the high growth rates of iran and Saudi Arabia could be sustained in the face of Libya’s expansion without creating a price-reducing surplus.

That the IPC continued its restrictive practices into recent years I corroborated by an excerpt from what Senator Muskie referred to as “this intelligence report,” which he read into the record of the Senate Subcommittee on Multinational Corporations on March 28, 1974. According to the Senator, the report was “dated February 1967 and it has to do with this question of the potential in Iraq.”

In 1966 a study was made of the geological, geographical and other petroleum exploration data of the areas of Iraq relinquished by IPC, Iraq Petroleum Co. The purpose of the study was to help government let new concessions and obtain more advantageous terms from foreign oil firms. The study indicated that the untapped reservoirs of oil in Iraq appear to be fantastic.

There is every evidence that millions of barrels of oil will be found in the new concessions. Some of those new vast oil reservoirs had been discovered previously by IPC but they were not exploited because of the distance to available transportations, the heavy expense of building new pipelines and the fact that IPC has had a surplus of oil in its fields that are already served by existing pipelines.

The files yielded proof that IPC had drilled and found wildcat wells that would have produced 50,000 barrels of oil per day. The firm plugged these wells and did not classify them at all because the availability of such information would have made the companies’ bargaining positions with Iraq more troublesome. Many of these areas had been returned to the Government in settlement of the petroleum concession conflict between the Government and IPC.

So How Much Oil Does Iraq Have ?

The ... difference between North Korea and Iraq is that we had virtually no economic options with Iraq because the country floats on a sea of oil - Paul Wolfowitz (2003)

Estimates of Iraqi oil reserves vary wildly, with the figures below showing the extent of the variation.

| Source | Estimated Reserves (billion barrels) |

| Colin Campbell (ASPO) | 61 |

| DOE / IEA | 112 |

| Oil and Gas Journal | 115 |

| BP Statistical Review | 115 |

| USGS | 145 |

| Petroleum Economist Magazine | 200 |

| Federation of American Scientists | 215 |

| Council on Foreign Relations / James A. Baker III Institute | 300 |

| Center for Global Energy Studies | 300 |

| Taha Hmud Moussa (Saddam's deputy oil minister) | 300 |

| Benito Livigni (former manager of ENI and Gulf Oil Company) | 400 |

On a more anecdotal note, one poster at peakoil.com referenced a comment about Iraqi reserves in the documentary, "The Power Of Nightmares".

I think it was a segment of the BBC's "The Power of Nightmares"in which the owner of a small British petroleum exploration and development firm spoke about Iraq's true reserve totals. He did not give a total estimate - because it's not known - only that there was an awful lot of oil in Iraq. He said it in such a way as to be more than emphatic - talking about the amount of oil in Iraq in dreamy tones as if he were a conquistador talking about el Dorado.

He had completed making certain arrangements for the development of specific untapped fields with the Iraqi leadership when 911, and the subsequent invasion of Iraq spoiled his plans.

Gal Luft's survey for the Brooking Insitution ("How Much Oil Does Iraq Have?") made the following notes about the uncertainty surrounding estimates.

Given Iraq's poor record of reporting on other issues of international concern, there is every reason to suspect that Saddam Hussein's regime was less than candid in its reports on oil reserve estimates—especially during the past 12 years, when Iraq's oil fields were inaccessible to reputable Western companies.

Even before the 1990-91 Gulf War, it was difficult to assess what still lay beneath the Iraqi sands. Most of the geological data about Iraq's reserves was gathered before the nationalization of the Iraq Petroleum Company in 1972. From then on, data on Iraq's oil reserves was closely guarded by Saddam's regime, which limited the ability of the international community to conduct an external audit. For the most part, Iraq's oil data has been marred with inconsistencies, gross approximations, and, at times, bold exaggerations. In 1987, for example, despite the fact that it was in the midst of war with Iran and its oil industry was mostly static, Iraq claimed to have more than doubled its reported reserves from 47 bbl to 100 bbl. The increase was a lie: it was just creative bookkeeping designed to increase Baghdad's OPEC quota rather than the result of new oil discoveries. Over the last six years, Iraq has claimed that its reserves have remained constant, despite the fact that it produced close to a billion barrels per year through the oil-for-food program and its various smuggling operations via Syria, Jordan, Turkey, and the Persian Gulf.

As for undiscovered reserves, external auditing is even more difficult and Iraq's claims are even more dubious. Issam al-Chalabi, Iraq's oil minister from 1987 to 1990, admitted in the March 24, 2003 issue of the OGJ that Iraq's oil figures are "preliminary in nature since work was often interrupted by political problems, and the technology used is now outdated." Large parts of the country, especially in Iraq's Western Desert and its northwest, are still untapped and need to be explored. This is where the DOE and USGS really part company. According to the DOE-EIA's Iraq web page, deep oil-bearing formations located in the vast Western Desert region could possibly yield as much as 100 bbl. This again contrasts with the detailed data of the USGS, which suggests only a 50 percent possibility of 6.6 bbl in Iraq's Western Desert petroleum system. Even under its most optimistic scenario, the USGS predicts no more than 14 bbl coming from this area.

However, there are some facts that are undisputed. First, Iraq has considerable oil reserves and low production costs. Second, because of Iraq's isolation over the last decade—during which exploration technology has greatly improved—there has been almost no use of the most sophisticated exploration techniques such as seismological surveys, magnetometers, and sniffers in Iraq. Furthermore, most of the fields have not been explored down to the deepest layers of the ground, where plenty of oil can be found. Out of the 74 fields that have been discovered and evaluated, only 15 are actually operating. In addition, there are 526 prospective drilling sites in Iraq today, but just 125 of them have actually been drilled. Of those, 90 have shown potential as oil fields, but only 30 have been even partially developed. This means that once on the ground with sophisticated exploration tools, petrogeologists could establish in relatively short time a far more accurate picture of the scope of Iraq's reserve than the one we have today.

The most recent assessment I've seen comes from Barham Salih (Iraq's Deputy Prime Minister) earlier this year, where he announced the country has the world’s largest proven oil reserves, with "as much as 350 billion barrels".

As Luft noted, Iraq's oil production costs are among the lowest in the world (estimated to be around US$1.50 per barrel), but only about 2,000 oil wells have been drilled in Iraq - compared with about 1 million wells in Texas alone, which underscores just how undeveloped the country is as an oil province.

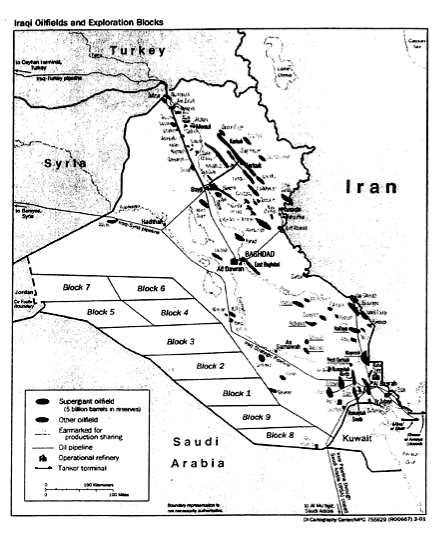

Some of the few artifacts that surfaced from the secretive "Energy Task Force" conducted by Dick Cheney in 2001 were a map of Iraq's oil, including a number of blocks in the western desert denoted "Earmarked for production sharing" along with a list of "Foreign Suitors for Iraqi Oilfield Contracts".

In David Strahan's book "The Last Oil Shock", he notes "the CIA was also well aware of Iraq’s unique value, having secretly paid for new maps of its petroleum geology to be drawn as early as 1998".

The Iraq Oil Law

One of our greatest helpers has been the State Department - John D Rockefeller (1909)

One of the more interesting pieces of political maneuvering in occupied Iraq has been the attempt to pass a law governing how Iraq's oil reserves and oil revenues will be divided and what role international oil companies will play in the country.

There have been persistent claims the law is about to be passed for well over a year, but so far the Iraqi Parliament has managed to avoid doing any such thing.

The proposed law has been the subject of a lot of controversy during that time (with the Bush administration making it one of the primary "benchmarks" it wants the Iraqi government to meet), with this summary of "key facts" from Oil Change International being a good outline of the major complaints:

The proposed Iraq hydrocarbon law would take the majority of Iraq’s oil out of the exclusive hands of the Iraqi government and open it to international oil companies for a generation or more. The law is a dramatic break from the past. Foreign oil companies will have a stake in Iraq’s vast oil wealth for the first time since 1972, when Iraq nationalized the oil industry.

BearingPoint, a Virginia based contractor is being paid $240m for its work in Iraq, winning an initial contract from the US Agency for International Development (USAid) within weeks of the fall of Saddam Hussein in 2003. A BearingPoint employee, based in the US embassy in Baghdad, was hired to advise the Iraqi Ministry of Oil on drawing up a new hydrocarbon law. BearingPoint employees gave $117,000 to the 2000 and 2004 Bush election campaigns, more than any other Iraq contractor.

The process of drafting the oil law has been particularly troubling. The timeline of which entities have seen the draft when suggests that Iraqi interests are not being considered first and foremost:

* Draft shown to US government and major oil companies – July 06

* Draft shown to the International Monetary Fund September 06

* Draft shown to Iraqi Parliament: February 07

The Iraq National Oil Company would have exclusive control of just 17 of Iraq’s 80 known oil fields, leaving two-thirds of known — and all of its as yet undiscovered — reserves open to foreign control.

The law sets no minimum standard for the extent to which foreign companies would not have to invest their earnings in the Iraqi economy, partner with Iraqi companies, hire Iraqi workers or share new technologies.

The international oil companies could also be offered some of the most corporate-friendly contracts in the world, including what are called production sharing agreements. These agreements are the oil industry’s preferred model, but are roundly rejected by all the top oil producing countries in the Middle East because they grant long-term contracts (20 to 30 years in the case of Iraq’s draft law) and greater control, ownership and profits to the companies than other models. In fact, they are used for only approximately 12 percent of the world’s oil.

Iraq’s neighbors Iran, Kuwait and Saudi Arabia maintain nationalized oil systems and have outlawed foreign control over oil development. They all hire international oil companies as contractors to provide specific services as needed, for a limited duration, and without giving the foreign company any direct interest in the oil produced

Iraqis may very well choose to use the expertise and experience of international oil companies. They are most likely to do so in a manner that best serves their own needs if they are freed from the tremendous external pressure being exercised by the Bush administration, the oil corporations — and the presence of 140,000 members of the American military.

The leadership of Iraq’s five trade union federations released a statement opposing the law and rejecting ‘’the handing of control over oil to foreign companies, which would undermine the sovereignty of the state and the dignity of the Iraqi people.’’ They ask for more time, less pressure and a chance at the democracy they have been promised.

When I first read about the proposed law, the point that instantly caught my eye was the handing over of all "undiscovered" oil to possible foreign exploitation - which makes a lot of sense if you consider Professor Blair's stories about suppressed oil discoveries back in the old days (along with large swathes of the country remaining unexplored).

Of course, the Iraqi government may have thwarted this particular tactic with it's announcement this year upping reserves to 350 billion barrels, thus restricting the "undiscovered" category to any amount found beyond this number.

The Iraqi Deputy Prime Minister told The Times that new exploration showed that his country has the world’s largest proven oil reserves, with as much as 350 billion barrels. The figure is triple the country’s present proven reserves and exceeds that of Saudi Arabia’s estimated 264 billion barrels of oil. Barham Salih said that the new estimate had been based on recent geological surveys and seismic data compiled by “reputable, international oil companies . . . This is a serious figure from credible sources.”

In the meantime the Iraqis are perhaps hoping they can dawdle over passing any law for as long as it takes for US troops to leave the country - something the Iraqis are asking to occur by 2011.

Various tactics have been tried by the oil companies as well, ranging from attempts to negotiate contracts directly with the Kurdish regional government in the north, to a range of no bid oil contracts (later cancelled) to the recent sell-off discussions in London that I started the post with (the outcome of which doesn't seem to have been reported anywhere that I can find).

Of course it’s about oil, we can’t really deny that - General John Abizaid (2007)

Conclusion

As we frequently find elsewhere, there is very little in the way of transparent data regarding Iraq's oil reserves, so many interpretations of what are going on seem to be basically political in nature.

However, given the history of Iraq's oil industry and its largely undeveloped state (even when considering well known reserves), I think some of the higher estimates for Iraq's oil reserves are likely true.

The Iraq Oil Ministry is continuing trying to get the oil law passed, and predicting potential production in the 10 million barrel per day range (even the limited sell off currently under consideration could result in an increase in production to 4.5 million barrels per day, according to the Wall Street Journal).

It is numbers like these that make me think the global decline rates we will see post peak won't be as steep as some people fear - however I hope that the Iraqis manage to free themselves from outside influences and get to determine the fate of their own property, rather than an occupying army ensuring that foreign oil firms take the lions share of the income this oil generates.

People say we’re not fighting for oil. Of course we are. They talk about America’s national interest. What the hell do you think they’re talking about? We’re not there for figs - Republican Senator Charles Hagel