The Utility Shift To Energy Solutions Provision

Posted by Big Gav in agl, australia, electricity demand, electricity grid, origin energy, utility death spiral

The Climate Spectator has a pair of articles looking at how Australian utilities are trying to avoid the utility death spiral - partly by resisting change and partly by trying to work out how to adapt to i. The first article looks at AGL, which has been marching backwards lately as it invests heavily in old (but very cheap) coal fired power plants - AGL's tense shift towards energy solutions provider.

Average household customer electricity consumption was down nearly 10 per cent for the year and this comes on top of similar falls in prior years (detailed in the chart below). Part of this year’s fall is attributed to the mild May and June but, nonetheless, “AGL expects average consumer demand to continue to be impacted by energy efficiency, solar and new technologies”.With less volume AGL finds itself unable to make the kind of margin per customer which it has in the past in the retail end of its business. Earnings per 'customer account' were down 16.7 per cent compared to last year for AGL. At the same time, the reduced energy sales also flow down the line to lower prices and margins in the power generation part of its business as well.

The problem for AGL, and indeed other power companies, is that energy equipment suppliers for buildings – such as solar PV but also other products, such as energy efficient lighting – are cutting their lunch. These equipment suppliers are helping customers to reduce the amount of energy they need from the grid.

AGL’s chief executive Michael Fraser appears acutely aware of this challenge. He suggests that the company needs to transition from a conventional vertically integrated energy supplier which makes money through selling volume of energy, to what they term an integrated energy solutions provider, which they symbolise in the picture below.

Essentially, AGL believes it needs to vertically integrate yet another step beyond the centralised grid and into its customers’ homes. Under such a model the company would make money less by selling electrons from the grid and more by charging for services linked to equipment such as solar PV, batteries and devices which would improve a household’s energy efficiency and shift its electricity demand out of the periods when power is most costly, such as very hot and very cold days.

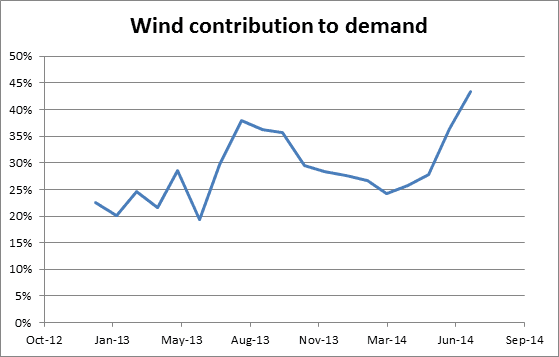

Boston Consulting Group released a paper recently looking at how this energy solution provision model may arise and the challenges it presents for traditional power utilities. BCG outlines in the diagram below how the revenues available upstream from the customer are likely to erode over time due to solar, cheaper batteries and more efficient and communication-enabled electrical equipment. It shows that while the revenue available to generation and power networks, declines, the available revenue for behind-the-meter equipment and services – as well as metering equipment – rises.

The second article looks at another of the big 3 Australian utility companies - Origin Energy - and how the rapid rise in east coast gas prices (caused by the export of coal seam gas as LNG) is impacting the generation mix - Origin hit by solar and efficiency demand drop.

Origin, like AGL, is also talking up its ability to vertically integrate into the customer-side of the grid to counter the loss of margins through lower grid-based electricity volumes. In its presentation to investors it states it is focusing on development of a “revitalised solar business, smart meter technology, electric vehicles, distributed generation and storage”.However, Origin does not elaborate on what is meant by its “revitalised strategy in solar”. In its latest results it notes gross profit decreased in its non-energy commodity business dropped by 35 per cent, or $17 million, primarily due to lower demand for rooftop solar PV systems. Origin used to be the largest solar retailer in the country but in the last few years its market share has declined dramatically.

At the same time Origin’s presentation seems to indicate that it is hopeful regulatory changes might alleviate declines in power consumption, such as changes to the Renewable Energy Target and adjusting network charges away from being averaged across energy consumption to more of a fixed nature.

Also, the company notes they’d be looking to limit capital investment in their energy markets division. This seems to suggest they see better opportunities in oil and gas rather than funneling money into provision of innovative energy solution offerings to replace lost grid sales.

Also just like AGL, Origin see prospects for returns to improve in conventional power generation with large price rises possible. They believe that there will be a mass withdrawal of around 15 terrawatt-hours of gas fired generation from the NEM as LNG plants suck in this gas. They also expect some further power plant capacity to be retired.

The utilisation of their mix of power plants (detailed in the table below) underlies the shift we’ll see. Darling Downs and Mortlake are running at quite high capacity factors given their position in the power plant merit order while the coal-fired Eraring operated at less than half its full capacity (45 per cent capacity factor).

One can imagine with gas rising to around $8 per gigajoule these plants will almost drop off the grid while Eraring’s output will increase considerably.