Petrol prices led tonight's TV news, with numerous complaints from various local bodies about recent and anticipated price rises and claims that people are getting priced out of being able to drive. One body called for a reduction in petrol taxes, while the Rodent says he will be discussing oil prices with American energy industry representatives on his forthcoming visit to Washington for his latest set of instructions. Apparently he will also consult with Alan Greenspan, who will no doubt tell him to cut interest rates (the solution to everything) and give him a copy of the CERA report and a show bag of methane hydrates.

The weekend Financial Review also featured oil heavily, with articles like The good oil on rising petrol prices, Rising thirst for oil keeps profits flowing, Optimists may be in for a shock, Struggle on the street no certainty, despite $US60 crude and Oil price blackens outlook for stocks (all hidden behind their subscription wall unfortunately).

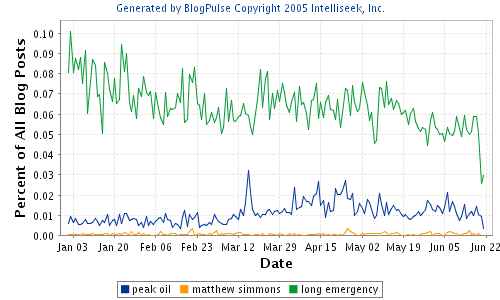

While they were happy to use peak oil as a trigger for kicking off their pro-nuclear campaign at the beginning of the year (which was replaced by the "cut greenhouse gas emissions" meme later on), they aren't so keen to relate current developments in the oil market to peak oil, with just one brief (and inaccurate) mention amid all the analysis.

The steadily rising oil price has also allowed the doomsayers to gain a new voice.

The so-called "peak oil" lobby [BG - we're a lobby ?] claims that global crude oil reserves have peaked and that steadily rising demand will outstrip the world's ability to supply, forcing prices higher.

Another interesting snippet was their take on the impact on the Australian economy as a whole. Even though our oil importation bill is rising rapidly (like our current account deficit), they tend to believe higher prices are a net positive (ignoring the possibility of these higher prices dampening growth, or worse, in China and/or the US).

Though a net oil importer, Australia is relatively rare among developed economies by being a net energy exporter - due to our reserves of natural gas and coal [BG - and uranium] - to the extent that higher oil prices are associated with higher energy prices in general, Australia's overall net income tends to rise.

In other news, apparently Arnie likes BHP's

proposal for an LNG terminal offshore from Los Angeles.

California governor Arnold Schwarzenegger has given the thumbs up to BHP Billiton's plan to build a $US4 billion ($5.2 billion) liquefied natural gas (LNG) terminal off the coast near Los Angeles. Mr Schwarzenegger named the BHP Billiton terminal as the "safest one for California" out of four proposals.

The governor said he liked BHP Billiton's proposal because the plan involved building a floating platform about 23 kilometres off the Oxnard coastline, just north of Los Angeles. Three other terminal proposals by competing energy groups would be built closer to land and major population centres, with one in the busy port of Long Beach.

"I think the [BHP Billiton] one, for instance, at Oxnard where you build it out approximately 11 or 12 miles off the shore, could probably be the most safest one for California," the Austrian-born former actor told a press conference in Alhambra, California.

The BHP Billiton terminal, which involves shipping LNG from Australia to the US west coast terminal, will be a significant boost to the Australian energy market if it is approved. It is estimated it would be worth $15 billion in exports for Australia.

I also noticed an ad for the Federal Government's

Renewable Energy Development Initiative (REDI). Although the amount of money is fairly paltry ($100 million) it is a step in the right direction. Doubling the

MRET would probably be a lot more effective though, as would putting in place some sort of program to encourage constantly increasing efficiency of all types of energy consumption (another article compared

electricity prices across developed nations, with Australia's coming in 3rd lowest - prices in the US are 50% higher than here, for example - although we hit a record for demand on Wednesday and prices briefly touched $9000 per MwH, so this may not be the case for too much longer).

REDI is a competitive merit-based grant program supporting Renewable Energy innovation and its commercialisation. REDI was announced on 15 June 2004 as part of the white paper, Securing Australia's Energy Future. It provides grant funding up to $100 million in competitive grants to allocate to Australian businesses over seven years. It offers grants of between $50,000 and $5 million for research and development (R&D), proof-of-concept, and early-stage commercialisation projects with high commercial and greenhouse gas abatement potential.

Technorati tags:

peak oil

TreeHugger has a post up about a new design for roof guttering that is optimised for the capture of rainwater into rainwater tanks. Given the need to conserve water here (especially with water prices increasing and water restrictions in place in most major cities), household rainwater tanks (like

TreeHugger has a post up about a new design for roof guttering that is optimised for the capture of rainwater into rainwater tanks. Given the need to conserve water here (especially with water prices increasing and water restrictions in place in most major cities), household rainwater tanks (like

Meanwhile, in England, the BBC reports that the cost of nuclear power has been

Meanwhile, in England, the BBC reports that the cost of nuclear power has been

Nuclear fusion taps energy from reactions like those that heat the Sun. Nuclear fusion is seen as a cleaner approach to power production than nuclear fission and fossil fuels.

Nuclear fusion taps energy from reactions like those that heat the Sun. Nuclear fusion is seen as a cleaner approach to power production than nuclear fission and fossil fuels.

What would they want to do with it ? Speculation ranges from use by special forces in remote areas, to powering remote unmanned sensing devices or even an off-grid power source for Dick Cheney's lair if the unthinkable happens...

What would they want to do with it ? Speculation ranges from use by special forces in remote areas, to powering remote unmanned sensing devices or even an off-grid power source for Dick Cheney's lair if the unthinkable happens...

Jared Diamond was in town a few weeks ago to give some talks as part of the Sydney Writers Festival. This

Jared Diamond was in town a few weeks ago to give some talks as part of the Sydney Writers Festival. This  Dave Roberts at

Dave Roberts at  RU Sirius has a great interview with

RU Sirius has a great interview with