21 Feet

Posted by Big Gav

The story of Greenland's melting ice cap is slowly reverberating through the media - TomPaine has a story on the impact of a 21 foot rise in ocean levels should the cap melt entirely, and the issues preventing the problem being tackled.

Diane Sawyer, anchoring ABC's "World News Tonight" simply repeated the most stark statistic from her network's report yesterday on the increasing melt rate of the Greenland ice sheet. "Twenty-one feet," she said. Twenty-one feet. That's how much the world's sea levels will rise when Greenland's ice fully melts.

Catastrophic melting will do more than just inundate the nation's coastal cities. California's Imperial Valley will flood, as levees are overcome by the rising waters. That will mean the devastation of one of America's great agricultural breadbaskets and the loss of Southern California's main source of freshwater. California may both drown and dry up before the big earthquake ever hits.

Melting will also change the world's weather patterns, especially in the northern hemisphere. Massive amounts of cold freshwater will likely shut down the Atlantic Ocean currents that bring the warm waters from the tropics up to heat Europe. Ironically, Northern Europe will get colder as a result of global warming, increasing its energy needs and devastating its agricultural cycles.

But until now, politicians in Washington have preferred to ignore or reject the real threats posed by global warming. The reason is simple. The solutions to this problem are too disruptive to vested interests.

The Independent is continuing their excellent global warming coverage, with one recent article noting that greenhouse gases are being released into the atmosphere 30 times faster than the last time the Earth experienced an episode of global warming.

AP has a report that claims that China and Iran are about to complete anothe huge oil deal - looks like Iran is working as fast as possible to get its possible protectors onside before the March security council deliberations on their nuclear program. The French certainly seem to be keen to be part of any new "coalition of the willing" this time round judging by their public posturing.

China and Iran are close to setting plans to develop Iran's Yadavaran oil field, according to published reports, in a multibillion-dollar deal that comes as Tehran faces the prospect of sanctions over its nuclear program. The deal is thought potentially to be worth about $100 billion.

According to Caijing, a respected financial magazine, a Chinese government delegation is due to visit Iran as early as March to formally sign an agreement allowing China Petrochemical Corp., also known as Sinopec, to develop Yadavaran.

The Wall Street Journal also reported in Friday's editions that the two sides are trying to conclude the deal in coming weeks before potential sanctions are imposed on Iran for its nuclear ambitions. The report cited unnamed Iranian oil ministry officials familiar with the talks. The deal would complete a memorandum of understanding signed in 2004.

In exchange for developing Yadavaran, one of Iran's largest onshore oil fields, China would agree to buy 10 million tons of liquefied natural gas a year for 25 years beginning in 2009, the Caijing report said, citing Sinopec board member Mou Shuling.

...

Western nations fear that Iran plans to develop nuclear weapons, but Iran insists its intentions are purely for generating electricity. Growing international concern about its aims contributed to Tehran being reported to the U.N. Security Council by the 35-nation board of the IAEA, the U.N.'s nuclear watchdog.

On Thursday, France's foreign minister, Philippe Douste-Blazy, accused Iran of secretly making nuclear weapons.

The Security Council is due to consider Iran's nuclear activities next month. The council has the power to impose economic and political sanctions on Iran, but members China and Russia could exercise their veto power against such measures.

Iran is also continuing its tactic of taunting the west, calling for the UK to withdraw troops from Basra, with a spokesman saying during a visit to Lebanon "Iran demands the immediate withdrawal of British forces from Basra". He also said "UK troops were destabilising the city".

The situation is steadily escalating with Syria as well, with reports that the country has switched all of the state's foreign currency transactions to euros from dollars. I've seen a few conspiracy theorists suggesting that Iran may be too tough a nut to crack (given that the Russians and Chinese may veto any UN authorised action thanks to the arms sales and oil deals they are getting from the Iranians), but an invasion of Syria and intervention of one sort or another in Lebanon would help clear the way for piping out oil from the north of Iraq (a largely autonomous Kurdistan) to the Mediterranean.

Ireland.com has an interesting interview with Syriana writer-director Stephen Gaghan.

The title Syriana comes from a term used by Washington think-tanks to describe a hypothetical reshaping of the Middle East. According to Gaghan, he is using it more abstractly, to refer to the "fallacious dream that you can successfully re-make nation states in your own image". So, despite the absence of clear-cut heroes and villains, he clearly does hold a strong view on the current US project of regime change in the region.

"But it's hard-earned," he argues. "I didn't start out with that perspective or with a pre-existing bias. I just went around and talked to as many people involved in the drama as I could, from the Arab side to the Washington, DC side. I talked to the families that own oil-producing countries and I talked to the middlemen in Europe and the people in American oil companies. I just went around and asked all these questions."

Along the way, he met everyone from neo-con intellectual Richard Perle to the leader of Hizbullah in Beirut, along with oilmen, financial analysts and arms dealers.

"Certain themes emerged, and my worldview shifted a little bit. What I thought about how it all worked changed. I became much more tolerant of the people involved. They were better people than I expected. When you talk to people they become humanised, and they're not the cardboard cutouts you expected or that you've reduced them to. But the level to which greed and a very narrow form of self-interest motivated the players in the drama - I was very surprised by that. There's much less altruism and much more 'I'm going to get mine now'. And that was really everybody."

One of the things that struck Gaghan most, and which comes across in the film, was how small and interlinked the world of power and influence in the oil industry is.

... the overriding impression one gets from Syriana is of a system of power which has been in place since the end of the second World War at least, but is beginning to collapse under the pressure of economic imperatives, political violence and global change.

"Exactly," says Gaghan, rather gleefully. "I think you can feel it coming, can't you? We've reached peak oil production, and the carbon economy's going to change. You have this incredible fact that China has 10 million cars now and in 20 years they're going to have 100 million cars. India's on the same trajectory. What does that mean for oil prices? They're not going to be within reach of the average person. There'll be giant structural shifts. I think it's exciting - and terrifying."

Tom Whipple's latest peak oil article in the Falls Church News Press looks at the rather frightening picture of depletion in Mexico's Cantarell field (the world's second largest).

Somewhere, between 65 million years ago and 1976, parts of this underwater rubble filled hole, filled up with about 35 billion barrels of oil. Making it one of the world's greatest oil fields. It is now called Cantarell.

Within a few years of its discovery in 1976, it was producing over a million barrels a day from only 40 wells. Fifteen years later however, the natural gas pressure driving out the oil started to give out and production started dropping. In response, the Mexican Oil Company PEMEX built a large nitrogen separation plant near the field and started injecting 1.2 billion cubic feet of high-pressure nitrogen into Cantarell each day.

The program worked like a dream; a few years later Cantarell was producing 2.1 million barrels per day— making it number two in the world right up there behind the Saudi's great Ghawar field which is producing on the order of 4.4 million barrels a day. This 2 million barrels a day represents about 60% of Mexican oil production and is what allows the country to export 1.82 million barrels a day most of which went to the United States.

Like all good things, massive flows of cheap oil must one day come to an end, so only four years after getting production up to over 2 million barrels a day, PEMEX announced the end was in sight and Cantarell was going into depletion. Last year, they announced the decline had actually started and that 2005 production would be down to 2.0 million barrels a day— 5% lower than in 2004.

There the matter rested. However, as we know in Washington , you simply can't keep a really good secret very long. Last week, somebody leaked the top secret PEMEX Cantarell Depletion study, and guess what? The situation might just well be a whole lot worse than the Mexicans have been letting on.

The BBC has a report that militants in the Niger delta are threatening "total war" in a campaign imaginatively named "dark February".

A Nigerian militant commander in the oil-rich southern Niger Delta has told the BBC his group is declaring "total war" on all foreign oil interests.

The Movement for the Emancipation of the Niger Delta has given oil companies and their employees until midnight on Friday night to leave the region. It recently blew up two oil pipelines, held four foreign oil workers hostage and sabotaged two major oilfields. The group wants greater control of the oil wealth produced on their land.

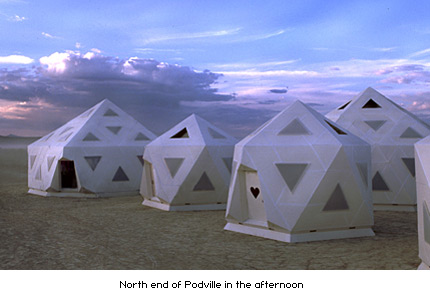

Apparently the first novel describing a post peak collapse - "After the Crash: An Essay-Novel of the Post-Hydrocarbon Era" - has been released - how much longer until a movie follows ? From the same source, a post of pod shelters, which is kind of intriguing...

Moving onto my favourite hobby horse the week (the ongoing rise of Big Brother), there is anoutrageous story from Houston that the local police are asking for surveillence cameras to be installed inside people's homes (as well as everywhere else) - the source doesn't look entirely impartial (and even credits Prison Planet), but the underlying report is from AP, so presumably its true. The Seattle Times has an editorial saying that Bush's script was written by George Orwell (not literally of course). Wisconsin Senator Feingold is fighting a lonely battle against both the renewal of the Patriot Act and the amazing likelihood that no action will be taken over Bush's illegal wiretapping campaign (maybe those conspiracy theories that the purpose of that campaign is to get dirt on Democrats so they can be blackmailed are true after all). TomPaine also has an article called "When Bush Makes Decisions that looks at some of the great cretin's latest policy disasters (and also refers to Colonel Wilkerson's darkly amusing recent analysis of the pros and cons of dictatorship vs democracy - dictatorships can work, but what happens when you have a dumb dictator ?).

The other headline, "U.S. Royalty Plan To Give Windfall To Oil Companies," is another example of Bush leading America further in the wrong direction. Beyond the breathtakingly bald raid on the U.S. Treasury, the move comes at a time when oil companies are posting record profits—in turn caused by the risk premium associated with Bush's ideological misadventure in the Persian Gulf.

Byron Dorgan, Democratic senator from North Dakota, has in fact called for a tax on oil companies' windfall profits. That initiative speaks to the level of frustration Americas are having with Washington's inability to put the country on a sustainable energy course. Indeed, the latest report from the Financial Times, published yesterday, says that geopolitical instability and major underinvestment in oil production capacity will result in years of higher oil prices. And that's before we consider leading oil investment banker Matthew Simmons' thesis that Saudi oil has peaked.

While I agree with Sen. Dorgan's goals, my own sense is that tit-for-tat treasury raiding is more catharsis than solution. I'm not in any way defending the oil oligopoly, but I think a windfall profits tax is just another band-aid. The longer-term solution that I would prefer is to increase the royalties the U.S. government charges on oil and gas extraction in the first place. In other words, what we should be doing is the exact opposite of what President Bush just anounced. Currently, I estimate that the royalty charged by the government is about $2/barrel. Oil prices are today $61/barrel. It's time to capture some of that value for the American people. It is after all, our oil.

Bush's action on oil royalties is a great example of the lengths to which our nation will go to make it look like oil is inexpensive at the gas pump. Since 1980, America has fooled itself into thinking that it could preserve the cheap energy conditions that existed after World War II.