Peaking Things

Posted by Big Gav

The Peak Metals idea got a bit of a workout last week (yes - I'm way behind on posting stuff), figuring prominently at Energy Bulletin, The Oil Drum and The Real Deal.

Call the theory Peak Metal. The price of gold and other metals, and related stocks, will keep rising as finding new sources gets harder and more expensive.[...]But I find the mechanisms that Peak Oil theory has developed to explain the direction of oil prices and the operation of the oil market immediately applicable to the metals sector.

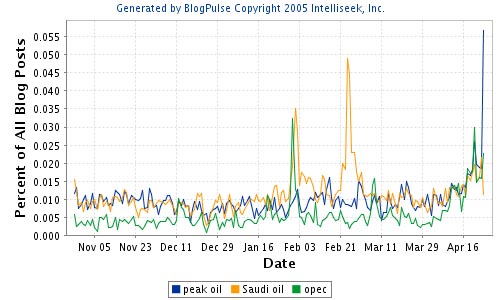

Interest in peak oil seems to be rising (if not peaking) again as well, as Heading Out shows in this post at The Oil Drum.

Another peak metal idea being floated (although I'm not sure anyone should care about it) is peak gold.

Perhaps the most important warning sign of a commodity peak are major producing countries individually peaking before the overall global peak. In the case of oil, the USA, China, Britain, Norway and Mexico amongst a host of others are at or past their national peak of oil production. We only await the Middle East countries and Russia to join them and complete the picture.

In the world of gold producing countries the picture is interesting if we examine a chart produced by the World Gold Council. In summary, South Africa peaked in the 1970s at 1000 tonnes (yet is still the main producer). The USA peaked in 1998 at 366 tonnes while Australia peaked in 1997 at 314 tonnes. Canada peaked in 1991 at 177 tonnes and Brazil in 1982 at 200 tonnes and so on. These example regions when combined currently produce 40% of the world's gold. If this 40% declines at 5% per annum then the other 60% has to increase production by 3% just to keep production flat. This is not a pretty picture - unless you hold gold.

Just like oil, the relatively few "giants" of gold production are being replaced by a host of smaller "minnows". Just like oil, gold explorers are finding less gold in lower grades of quality. In terms of oil, the gold Ghawars and Cantarells have long been discovered and exploited. It is now basically a mopping up operation at the edges of exploration.

It seems to me that Peak Gold may well have arrived. When Peak Oil arrives as well, then Peak Gold will be confirmed because increasingly higher energy costs will make many mines uneconomic and gold above ground will become far more expensive than gold shut in underground.

Past Peak has a look at "peak tires", which examine a subject many mining company analysts have described in the financial press here - the soaring cost and increasing difficulty of obtaining the enormous tires used by vehicles in the mining industry (if you ever go near a large open cut iron ore mine is worthwhile finding an opportunity to stand next to one of these things - they're huge !).

Economists look at peak oil (and peak copper, peak nickel, and peak everything else) and say the market will provide. As commodity prices rise, producers will be able to make a profit extracting resources from places that previously were unprofitable, in effect increasing the supply.

But it's not that simple. The fundamental problem is the sheer scale of world resource use. It takes more than money. There are physical constraints on how quickly some things can be done. There's a lot of oil in Canadian tar sands, for example, but no amount of investment capital is going to make it possible to extract more than a few million barrels a day in the foreseeable future. Likewise, producers of conventional oil (i.e., oil from wells, not from tar sands or shale) may want to drill lots more wells, but all of the world's oil rigs are already in use. Building more will take time. And there are only a finite number of people with the needed expertise to make these things happen. Training more will take even more time.

Part of the problem is that price signals arrive too late. What causes prices to rise is a shortage in current production. Draining the world's reservoirs doesn't get reflected in prices until the situation has become so dire that producers can no longer pump oil fast enough. By then, it's too late. Investment in alternatives has a long lead time, so it should have started long before shortages show up in prices.

All of which is preamble to the following NYT story (via EuroTrib):The worldwide thirst for stuff from the ground — materials as diverse as copper and coal, gold and oil — has set off a stunning boom in just about every commodity market. But there is one item that lately has dealers in the global mining industry really scrambling: the supersize tire.

Mining companies are complaining about a shortfall in the supply of the giant tires that go on large dump trucks and other heavy equipment. These outsize tires stand as tall as 12 feet tall and can spread 4 feet wide....

Energy Bulletin today tagged a Salon article as "peak water". Unlike oil we don't actually deplete water - we just move it around - but the combination of global warming and aquifer depletion may make many areas fell like their water supplies have peaked and gone into decline. Places like Goulburn for example.

We don't really know as we pick up the food from the store whether our purchases are responsible for making some local crisis elsewhere worse, but it is often the case. Many countries are facing serious water shortages; often their rivers are running dry, or their water tables falling very fast, and in many cases much of that water is being exported by those countries in the form of goods. Yet, when we pay market price for those goods, that price doesn't usually include any estimate of the cost to the water resources. We still think of water as an unlimited resource rather like the air we breathe.

Unfortunately the air we breathe isn't an unlimited resource either - and if even a Salon writer who seems to focus on environmental issues doesn't realise it, then we're all in trouble...

When I first put together the peak oil portfolio I lamented the fact that my self-imposed rules didn't let me short sell obvious peak oil victims like airlines. As it turned out this wasn't such a bad thing, as Qantas surged about 25% in the following 6 months, thanks to a pullback in the oil price, good hedging and their ability to continuously cut labour costs. Nothing can defy gravity forever though, and Qantas' share price is now heading earthwards.

It was flying above $4 not long ago, up there with Santa Claus, the Easter Bunny and pigs.

QANTAS'S share price is looking decidedly shaky after Macquarie Equities became the first broker to take a machete to the airline's profit outlook, thanks to the recent surge in oil prices.

Shares in the airline fell 7c to $3.49 yesterday and are now 19 per cent down from their February high. Barely a month after Macquarie slashed its full-year net profit forecasts for Qantas by 15 per cent to $626.3 million, the broker has slashed the figure another 2 per cent. But for 2006-07, Macquarie has cut its $732 million net profit forecast by 26 per cent to $542 million.

The broker has based its forecasts on "the forward jet fuel curve … disclosed hedging and … the [estimated] yield increase that can be digested in each segment of the market, along with the estimated demand response".

Some airline analysts see a bright lining to this silver cloud. Why they think oil prices are heading back down in 2 years time remains a mystery though.

The aviation industry must get used to tight market conditions, with oil prices forecast to remain above $US60 per barrel for the next two years at least, according to analysts. And with hikes in fuel surcharges limited by their potential negative impact on consumers, airlines are expected to offset higher oil prices by finding better and cheaper ways to do business. Experts predict that the aviation industry will not only see more carriers shifting to the low cost platform, but also more code-sharing and consolidation.

The Baltimore Sun has a good editorial called "Oiloholic nation has no business lecturing China" which takes a fairly realistic view of Bush's gall lecturing the Chinese about their growing oil consumption.

President Bush is reportedly annoyed that the Chinese are using so much petroleum. With the world's fastest-growing economy, China's oil consumption has soared to at least 6.5 million barrels a day, and its market for automobiles is growing. If the boom continues, the Chinese may eventually be somewhere in the neighborhood of the United States, which burns up about 20 million barrels a day.

Who do those Chinese think they are - Americans?

If that sounds arrogant, well, it is. Indeed, it takes a lot of chutzpah to chide a country that consumes about a third of the petroleum the United States does. While we account for less than 5 percent of the world's people, we use up about a quarter of the world's energy. And we Americans apparently think we have the God-given right to do so.

President Bush is annoyed not only by China's consumption but also by its efforts to ensure access to enough petroleum in the decades to come. China has done that by putting its interests ahead of considerations such as world peace - conducting business with unsavory characters such as Iranian President Mahmoud Ahmadinejad.

If China were a proper superpower, like us, it would just invade a sovereign nation to guarantee access to oil. After all, that was one of the reasons for Mr. Bush's fierce determination to topple Saddam Hussein; the administration was after permanent bases for U.S. troops, so they could guarantee our access to vital Middle East oilfields.

You still don't believe oil was a factor in the invasion of Iraq? Just listen to retired Army Col. Lawrence Wilkerson, former chief of staff to Colin L. Powell. In a speech in Washington last year, Mr. Wilkerson, an outspoken critic of the Bush administration's unilateralism, revealed a plan that was far more ambitious - and ominous.

"We had a discussion in policy planning about actually mounting an operation to take the oilfields in the Middle East, internationalize them, put them under some sort of U.N. trusteeship and administer the revenues and the oil accordingly. That's how serious we thought about it," he said.

Or listen to Newt Gingrich, who has led the chorus of right-wing saber-rattling against Iran. As Mr. Gingrich told The Atlanta Journal-Constitution, "The American people, if you put the decision in the context of controlling Iran and maintaining our access to oil, you'd get 60 to 65 percent reluctantly agreeing to do what it takes."

At least Mr. Gingrich was principled enough to own up to a fundamental tenet of U.S. policy toward the Middle East: Preserve our access to petroleum.

The New York Times' editorial on the same topic was very similar in tone and content - "How Dare They Use Our Oil !".

Newt may be "principled enough to own up" about US policy and the average person's reaction to the energy situation if it were clearly described to them (and I think he's probably right about this), but I'd never categorise him as a principled or an honest person. Unfortunately people like Jay Hanson and Jim Kunstler often express views which seem broadly similar to Newt's - America must do whatever it takes to control access to the remaining oil - otherwise terrible things will happen. Of course - this offers no sort of positive vision for the future - just increasingly brutish resource wars over oil.

The hunt for scapegoats appears to be getting into full swing, with Bush apparently deciding to get in on the new sport of blaming oil companies (not entirely unjustifiably) - though its possible he might just be creating a toothless body to investigate price gouging while avoiding doing anything that would antagonise his base. Bush is also touting the hydrogen economy once again.

When the Going Gets Tough, the Tough Get Blaming - Rising oil prices send lawmakers into frenzy of empty gestures

The American public will take lots of things lying down -- inaction on climate change, ill-conceived wars, erosion of civil liberties -- but expensive gas? Hell no! With oil prices topping $75 a barrel, gas prices sneaking up on $3 a gallon, and some East Coast gas stations running dry, Americans are demanding demagoguery from their lawmakers, and lawmakers are asking "how high?" Some legislators are pushing for a windfall tax on oil companies; others are calling for inquiries into price gouging; still others want to loosen environmental regulations on gasoline. House Speaker Dennis Hastert (R-Ill.), of all people, is complaining about the compensation package of outgoing Exxon honcho Lee Raymond, of all things. Gas types blame the shift from MTBE to ethanol; oil companies blame the market. President Bush says prices are only going to get higher, and there's not much the government can do about it. When Bush is the voice of reason, you know we're in a world of trouble.

The latest installment of Peak Oil Passnotes has some choice words to say about the blame game too.

Next week we will see the 10th meeting of the International Energy Forum (IEF) in Doha. It is another one of those interminable political groupings that gets together now and again to tell us how good/bad it all is. Of course you can tell what the main topic of conversation will be, $70-plus oil.

The sole interesting thing about the IEF is that it tries to throw together producer countries and consumer countries ministers. Back when it first met, it was falling prices that caused the alarm. With the timing being as it is, meaning the record prices we have seen this week, there is little doubt that the ministers will be completely preoccupied.

We are going to hear repeats of the usual political meanderings. OECD countries (the rich ones) will basically try and push the entire blame on to OPEC. They will say OPEC needs to produce more, chiefly to satisfy their domestic audience. It sounds strong and macho if you blame a whole load of Arab nations.

OPEC will be summoned to produce more oil. The fact that they have not only been busting their own quotas for around three years now, the fact that they effectively dispensed with their quota system last year, will not matter. Last year the British second in command Gordon Brown, blew his credibility amongst oil analysts and watchers by demanding OPEC, guess what, produce more oil.

Amazingly, and we are being sarcastic here, it was just a few days before planned fuel protests against high pump prices by a disgruntled British public. The protests collapsed as organisers were scared they would be seen as allies of OPEC. It was a cynical and cheap move by New Labour and it ended Brown's credibility in the oil industry.

We are also likely to hear that oft repeated mantra, the growth of China and India. It is those pesky wanabees from the east messing it all up. It is true that China and India are sucking up more crude and refined product, but they are still miniscule consumers compared to the big boys, the United States and the European Union countries.

In China, the government is effectively rationing fuel to their own population. By keeping fuel cheap in China, the Chinese refinery industry does not want to sell it to its own people, so they export. Almost certainly this is being done so the Chinese do not over heat the market even more and bring their export-led boom down around their Pandas' ears.

Then in reply to attacks the OPEC ministers will respond with their normal rebuttal. That there is a refining bottleneck, caused by a lack of investment from the OECD nations and the International Oil Companies (IOCs). They will, quite rightly, point to the fact that they are the ones building all the new refining capacity. That is either to supply us in the OECD nations - and the new markets - with product, or if you are a peak oiler, to supply themselves with it as crude dwindles.

Poor nations who have no supplies of their own and have to import their fuels, well, who cares about them? They are shafted either way and they are not invited.

Update: I see Past Peak is also pondering both the blame game and the average person's reaction to energy shortages - I guess we have similar interests.

And so we're treated to Republican Bush today posed in front of a backdrop more befitting a granola-eating, Birkenstock-wearing Green, speaking about investigating Big Oil for price-gouging. Republicans in both houses of Congress are jumping on the bandwagon. WaPo:Sen. Arlen Specter (R-Pa.) said this week that a windfall-profits tax on oil companies is "worth considering."

Rep. Joe Barton (R-Tex.), chairman of the House Energy and Commerce Committee, joined other lawmakers yesterday in condemning high oil prices by taking aim at oil companies. Barton said his committee will hold hearings into the imbalance of supply and demand. He added that "it troubles me" that Exxon Mobil Corp.'s chief executive received a large pay and retirement package "while refinery capacity continues to lag behind demand in this country."

Republicans talking about taxing profits, of all things.

It would be nice if the Dems would use the opportunity to take the high ground via straight talk about the world supply future and the urgent need to take serious steps on fuel efficiency and development of alternatives. But, as usual, their proposals are mostly Republican Lite. (Although Bill Clinton, at least, did recently acknowledge Peak Oil in a speech in London.)

...

At the end of the film 1975 Three Days of the Condor, Robert Redford's character, a CIA analyst, confronts his superior, played by Cliff Robertson. Remember, this was 1975:Turner (Robert Redford): "Do we have plans to invade the Middle East?"

Higgins (Cliff Robertson): "Are you crazy?"

Turner: "Am I?"

Higgins: "Look, Turner..."

Turner: "Do we have plans?"

Higgins: "No. Absolutely not. We have games. That's all. We play games. What if? How many men? What would it take? Is there a cheaper way to destabilize a régime? That's what we're paid to do."

Turner: "Go on. So Atwood just took the game too seriously. He was really going to do it, wasn't he?”

Higgins: "It was a renegade operation. Atwood knew 54-12 would never authorize it. There was no way, not with the heat on the Company.”

Turner: "What if there hadn't been any heat? Supposing I hadn't stumbled on a plan? Say nobody had?"

Higgins: "Different ball game. The fact is there was nothing wrong with the plan. Oh, the plan was alright. The plan would have worked."

Turner: "Boy, what is it with you people? You think not getting caught in a lie is the same thing as telling the truth?"

Higgins: "No. It's simple economics. Today it's oil, right? In 10 or 15 years - food, Plutonium. And maybe even sooner. Now what do you think the people are gonna want us to do then?

Turner: "Ask them."

Higgins: "Not now - then. Ask them when they're running out. Ask them when there's no heat in their homes and they're cold. Ask them when their engines stop. Ask them when people who've never known hunger start going hungry. Do you want to know something? They won't want us to ask them. They'll just want us to get it for them."

The correlation between oil prices and political fortunes will, as prices inevitably climb higher, open the door to opportunistic demagogues and hardliners, here in the US and throughout the world. Reason number 1,001 why we need to conserve — now.

While I'm tacking things on to the end of the post, I'll also let Billmon have a few words on the blame game...

Bush Orders Probe Into Gas Pricing

President Bush has asked the Energy and Justice departments to investigate whether gasoline prices have been illegally manipulated, he announced in a speech this morning . . .

This year, Republicans, who are traditionally more sympathetic to the pleas of Big Oil, are lambasting the oil companies, with some calling for the consideration of a windfall-profits tax on the firms.

There was a time when no Republican worth his Adam Smith tie would have dared advocate something as flagrantly socialistic as a windfall profits tax — not with Ronald Reagan around to hear it. I can almost hear St. Ronnie now: "A tax on profits? What is this, France?"

As for "price gouging," well, that was simply the forces of supply and demand in motion, as benign and inexorable as the movements of the planets. The economic concept of "rent" wasn't in the GOP lexicon back then — it was Adam Smith's profile on all those ties, not David Ricardo's. If conservatives knew one big thing, it was that free enterprise, liberated from the dead hand of the state, would solve any supply problem, as long as marginal tax rates were kept low and capital was allowed to migrate to the highest rate of profit. It said a lot about the ideological spirit of the early Reagan era that so many Republicans were willing, even proud, to stand up and make that argument on behalf of Big Oil, the industry Americans have loved to hate since John D. Rockefeller first started playing Monopoly.

But that was twenty five years ago, before the Republicans traded the Laffer Curve for the sign of the cross. Conservatism these days is a burnt out hulk — intellectually adrift, compromised by power, hopelessly hooked on pork, desperately trying to stay one step ahead of the voters (not to mention the Justice Department.) And that's what the conservatives are saying. If there's no honor among thieves, there is even less among the political whores who've inherited the House that Tom built:Rep. Joe Barton (R-Tex.), chairman of the House Energy and Commerce Committee, joined other lawmakers yesterday in condemning high oil prices by taking aim at oil companies. Barton said his committee will hold hearings into the imbalance of supply and demand. He added that "it troubles me" that Exxon Mobil Corp.'s chief executive received a large pay and retirement package "while refinery capacity continues to lag behind demand in this country."

Of course, those monster pay packages never bothered Joe when he was sucking up Big Oil's money — more than a half a million bucks of it during the last four election cycles. If an honest politician is one who stays bought, then Exxon Mobil has done as much as anyone can reasonably expect to keep Joe on the side of the angels.