Feeling Peaked ?

Posted by Big Gav in paul krugman, peak oil

Paul Krugman is feeling a bit peaked.

Peak oil, that is — a dismal theory that keeps getting more plausible.

A curious fact: a couple of years ago the firmly held belief of many right-wing economic commentators (why is this ideological? I’m not sure, but it was) was that the spectacular rise in home prices wasn’t a bubble, but that the rise in oil prices was.Oil prices are set to crash from this week’s record highs as a speculative market bubble bursts with an impact that could make the hi-tech bust of 2000 ‘look like a picnic’, business publisher Steve Forbes has predicted.

Forbes said the high oil prices currently dampening the US economy, which peaked at more than 70 usd a barrel yesterday as Hurricane Katrina headed for the US Gulf Coast, would fall to 30-35 usd a barrel within a year.

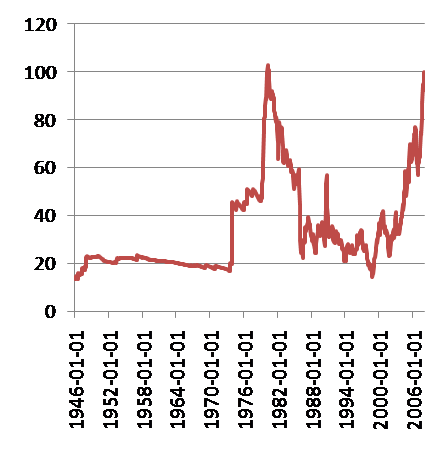

I took oil price and CPI data from FRED, the Federal Reserve Bank of St. Louis database — an incredibly useful resource. I just guessed at 0.3 percent inflation for February, and used an oil price of $100 for the last data point.

Add: Commenter Gufblog asks, “Isn’t it true that at above $40 a barrel Venezuela and Canada can start profitably turning oil sands and other hard-to-get-at sources into petroleum (which together more than double the world’s total supply and elevate Venezuela to the nation holding the greatest reserves)?” Well, people say that — but they’re always saying something like that. My first serious economics work was during the first oil crisis, when I spent many hours with Bureau of Mines publications containing firm estimates of the price of shale oil and oil-from-coal, all of which said that huge alternative supplies should be arriving any day now. Eventually people began talking about “Weitzmann’s Law,” which was that the cost of alternatives to conventional crude is 40% above the current price — whatever the current price is. Seriously, don’t believe the hype: history says that these things always fall short of expectations.

Meanwhile Bloomberg is reporting "Oil at $100 May Look `Cheap' Within Five Years, Alfa Bank Says ".

Crude oil prices of $100 may look ``cheap'' within five years if OPEC production fails to keep pace with global demand growth, according to Alfa Bank. ``We may hit peak oil in the course of the next three, four or five years, in which case $100 oil will look somewhat quaint,'' Alfa Bank's Moscow-based Head of Research Ronald Smith said in an interview with Bloomberg television.

Peak oil is the theory that global crude production is set to decline as new discoveries fail to make up for falling output from older oilfields. Some forecasts indicate Saudi Arabia, the largest producer in the Organization of Petroleum Exporting Countries, may be unable to reach sustainable output of 15 million barrels a day and fail to meet an annual demand increase of 1.5 million barrels a day, Smith said.

Global oil demand will ``hold up'' in the event of a U.S. slowdown as consumption growth is led by Asian and Middle East importers, while usage within the U.S. itself ``has not shown much sensitivity'' in the past to weaker economic activity.

Over at the BBC the question is "Who knows why oil prices are so high" ?. What happened to Adam Porter ?