Russian Oil Has Peaked ?

Posted by Big Gav in peak oil, russia

Bloomberg reports that a Russian oil oligarch is saying that Russian oil production has peaked. He is also asking for a government handout to do more exploration, which immediately makes me suspicious of course.

Oil output in Russia, the world's biggest supplier after Saudi Arabia, has ``peaked'' and may decline in the coming years, said billionaire Viktor Vekselberg, an owner of BP Plc's venture TNK-BP. Russian companies need tax breaks to spur exploration and development of new fields to revive growth, Vekselberg told an American Chamber of Commerce conference in Moscow today.

Oil output is falling for the first time in a decade as Soviet-era wells dry up and the costs of developing harder-to- reach deposits surge. Russia pumped 9.76 million barrels a day in March, down from 9.83 million in December, according to CDU TEK, the Energy Ministry's central dispatch unit. ``The output level we have today is a plateau, stagnation,'' Energy Minister Viktor Khristenko said in an interview April 10.

A drop in annual output would end a 58 percent surge in production since 1998, when Russia defaulted on about $40 billion of domestic debt and devalued the ruble. That year, Urals crude, Russia's benchmark blend, averaged $12.02 a barrel. The price reached a record $111.72 yesterday.

Khebab also has a look at Russian oil production at TOD.

Since 2005, the Russian oil industry has been in constant turmoil. Production growth has also slow down significantly maybe as a result. The Exxon Sakhalin-I project has now reached its peak and production is experiencing a steep decline since. On the upside, many projects are expected to come online and the IEA forecasts that oil production in Russia will increase by 90,000 bbl/d in 2008 and 300,000 bbl/d in 2009, following growth of 200,000 bbl/d in 2007.

The dramatic drop down in production growth observed by Stuart is still going on and is now close to 0 (i.e. flat production). Several trend lines can be drawn, in particular the trend for 2007 in purple would imply an immediate decline in 2008. However, several decline acceleration periods have occurred in the past (similar lines could have been drawn in 2001 and 2004) so it is unlikely that the rapid decline observed in 2007 will continue in 2008.

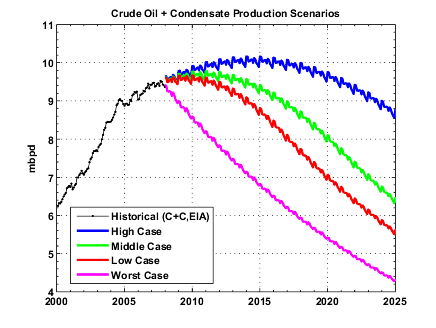

From the above linear trends, we can derive different oil production scenarios as shown [above] where peak production is seen between 2010 and 2015 with a peak production between 9.5 and 10 mbpd.

In terms of corresponding oil reserves, these scenarios are consistent with published reserve numbers. Using various reserve estimates gathered by Dave Cohen, I derived an empirical reserve cumulative distribution function (CDF). We can see that the dotted green line (Middle case) around 105 Gb is close to the median estimate at 116 Gb (F50).

Jonathan at Past Peak points to a Wall Street Journal article on the same topic.

This is one of those stories that probably ought to be front page news all over the world. Oil production in Russia, the world's largest oil producer, declined in Q1 for the first time in a decade. ... New oil pockets are being found in "increasingly remote climates" because that's all that's left. That's what peak oil looks like. Various other news stories, like this one in the Financial Times, cite all sorts of temporary reasons why Russian output is slumping.