Next Target For Oil: $200

Posted by Big Gav in oil price

Bloomberg reports that the (not entirely impartial) Goldman Sachs crew has upped their oil price estimate to the U$150 - US$200 per barrel range.

Crude oil may rise to between $150 and $200 a barrel within two years as growth in supply fails to keep pace with increased demand from developing nations, Goldman Sachs Group Inc. analysts led by Arjun N. Murti said in a report.

New York-based Murti first wrote of a ``super spike'' in March 2005, when he said oil prices could range between $50 and $105 a barrel through 2009. The price of crude traded in New York averaged $56.71 in 2005, $66.23 in 2006 and $72.36 in 2007. Oil rose to an intraday record of $122.49 today on speculation demand will rise during the peak U.S. summer driving season.

``The possibility of $150-$200 per barrel seems increasingly likely over the next six-24 months, though predicting the ultimate peak in oil prices as well as the remaining duration of the upcycle remains a major uncertainty,'' the Goldman analysts wrote in the report dated May 5.

A report yesterday showed U.S. service industries expanded in April, signaling higher energy use. The Institute for Supply Management said its index of non-manufacturing businesses, which make up almost 90 percent of the economy, grew for the first time since December. China is increasing refining capacity and boosting imports to meet rising demand for the Olympic Games.

U.S. gasoline demand typically climbs going into the summer season when Americans take to the highways for vacations. The peak-consumption period lasts from the Memorial Day weekend in late May to Labor Day in early September. Monthly fuel sales were the highest during August in five of the last six years, according to data from the Department of Energy.

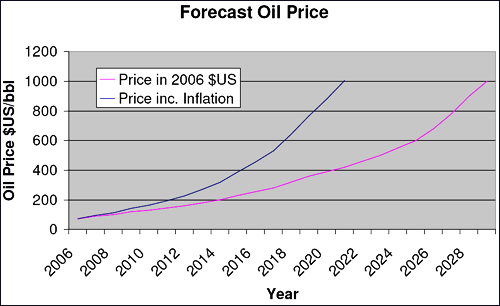

"Phoenix" has a guest post at TOD ANZ on his oil price forecast. I'm hoping he will let us post the spreadsheet that includes his model at some point in the not-too-distant future.

So what’s a barrel of oil really worth?

At the start of 2006 I became peak oil aware. Most of the readers of TOD will have lived through the turmoil of concern and dismay that this realisation usually brings on. In the months following, I proceeded to digest as much information on the topic as I could. However, after a time I noted that, while there was an abundance of predictions on amounts of oil and the depletion rates, there was little in the way of forecasts as to the future oil prices that would result.

At that time (and still today) I was an avid believer that the consequences of oil depletion will unfold as an economic crisis rather than as direct impacts from the shortage of energy. This being the case then why was there virtually no debate or a plethora of predictions as to the long range prices?

Perhaps everyone was relying on the output of the IEA for such forecasts? A quick review of the IEA numbers at the time was distressing. They were forecasting a drop in the price back to the US$40-$50 range. Even worse, world governments were probably using these predictions to set energy, social and infrastructure policy. I decided for my own piece of mind, to attempt to generate a simple model for predicting the long range oil price.

Basic Theory

Traditional oil market economic theory seems to be modelled around the notion that the price for a commodity is simply a reflection of the input costs. Markets, while they may experience temporary upsets due to imbalance between supply and demand, through the forces of competition will correct themselves so that prices are governed by costs.

Being an engineer rather than an economist I felt at liberty to toss the above theory out the window. It seemed to me overly reliant on the concept that the world was infinite and that markets always have the capacity to expand to meet demand.

Instead I started from the premise that the production of a commodity is limited. Of all those people vying for the commodity someone inevitably will miss out. They will not be able or willing to pay the market price. The price then will be governed by the maximum amount that this person is prepared to pay. ...

Neil King at the WSJ reports that even Daniel Yergin has given up on his predictions of $30 a barrel oil and is now conceding $150 is possible - though if you view Yergin as a contrarian indicator then this may mean a slump will commence in the near future.

At the pump, $150 oil translates into gasoline prices of more than $4.50 a gallon, putting further strain on U.S. auto makers, airlines and utilities. It would also stoke the political debate in Washington. Regular grade gasoline in April averaged $3.46 a gallon.

Oil watchers say most signs point toward a continued increase in prices. Despite talk that speculators have driven up crude prices as a hedge against the slumping dollar, oil has rallied 10% since the first week in April while the dollar has risen about 2% against the euro.

Even more unusual is that oil has maintained its upward momentum in the face of sharply diminished U.S. demand, which fell in February to 19.7 million barrels a day. That was down a million barrels a day from the 2007 average. An increase in U.S. demand, perhaps driven by the $152 billion in government stimulus payments to consumers, could crimp an already tight international oil market.

The main factors that could send prices down, analysts say, would be a sharp downturn in global oil demand or some sudden flight from commodities among international investors.

"It's not that the genie is out of the bottle -- it's that 100 genies are out of the bottle," said Daniel Yergin, chairman of Cambridge Energy Research Associates. Normally known for optimistic forecasts of lowering oil prices, Mr. Yergin's firm now says the price could rise to $150 a barrel this year.

The world's diminished spare production capacity remains the strongest single catalyst for high prices, Mr. Yergin says. The world's safety cushion -- the amount of readily available oil that could be pumped in a moment of crisis -- is now around two million barrels a day, according to most estimates. That's just 2.3% of daily demand, and nearly all of the safety cushion is in one country, Saudi Arabia. Everyone else is pretty much pumping all they can, which makes the world vulnerable to political or other shocks.

The oil market has become all the more skittish amid a raft of gloomy news from big oil producers. Indonesia, a longtime member of the Organization of Petroleum Exporting Countries, says it may pull out of the cartel next year as its production continues to fall to less than half its peak of 1.7 million barrels a day in the early 1990s. Indonesia has been a net oil importer since 2004.