Fueling the peak oil debate in Saudi Arabia

Posted by Big Gav in aramco, peak oil, saudi arabia

Neil King at the WSJ has a look at the 2 ends of the Aramco spectrum of opinion on peak oil - Sadad al-Husseini and Nansen Saleri - in Global Oil-Supply Worries Fuel Debate in Saudi Arabia.

Neil King at the WSJ has a look at the 2 ends of the Aramco spectrum of opinion on peak oil - Sadad al-Husseini and Nansen Saleri - in Global Oil-Supply Worries Fuel Debate in Saudi Arabia.

Sadad al-Husseini and Nansen Saleri raced up the ranks at Saudi Aramco, the world's most powerful oil company, working together for years to squeeze more crude from Saudi Arabia's massive fields. Today, the two men have staked out opposite sides of a momentous industry debate.

Mr. Husseini, Aramco's second-in-command until 2004, says the world faces a brute reality of depleting resources and ever rising prices. Mr. Saleri, until recently the company's oil-reservoir manager, insists that with enough ingenuity and investment, plenty more oil can be found.

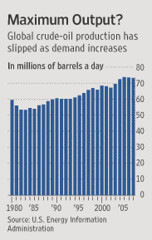

With oil prices having doubled over the past year, political leaders, Wall Street investors, commuters, airlines and car makers are all scrambling to divine where prices will head next. The disparity of opinion between two of the most knowledgeable men in the industry shows how much fog hangs over the most basic question of all -- whether oil can be unearthed any faster than it currently is.

At the moment, Mr. Husseini's pessimistic view is clearly ascendant. Even before this year's surge in oil prices, there were gloomy industry predictions that world oil output would soon hit a ceiling. U.S. benchmark crude hit a record high on Thursday, propelled by Libyan threats of possible supply cuts, closing at $139.64 a barrel, up more than threefold since 2004. (Please see related article.)

But Mr. Saleri isn't alone in dismissing the gloom as misplaced. Optimists, from Exxon Mobil Corp. to the U.S. Energy Department, argue that high prices propel companies to innovate and invest more. As supplies rebound, prices will fall from today's levels.

Saudi Arabia itself, producer of 12% of the world's oil, has vacillated for years over whether to try to extract oil faster than it already is. Last weekend, urged on by Saudi King Abdullah, it appeared to move into Mr. Saleri's camp. Fearful that supply jitters were damaging the world economy, the kingdom said it was ready to invest tens of billions of dollars to boost its capacity to unprecedented levels -- to 15 million barrels a day over the next decade, from just over 11 million now.

Opinions within the region on the health of the Persian Gulf's remaining petroleum riches vary more widely than many realize. Messrs. Husseini and Saleri disagree over whether the new Saudi production target is either feasible or wise -- echoing a debate that has swirled behind the scenes at Aramco for years.

That the two men worked side by side at the company that controls one-quarter of the world's proven oil reserves makes their divergent outlooks all the more striking.

Mr. Husseini, now an independent consultant, has jetted around the world spreading his views, including recently over dinner with George Soros and a clutch of other top financiers. Mr. Saleri has lectured, written opinion pieces and buttonholed top oil officials from Latin America to Kuwait.

Mr. Husseini, 61 years old, lives across the street from the Saudi oil minister, Ali Naimi, in a leafy neighborhood of Dhahran, the Aramco company town on Saudi Arabia's east coast. The suave but sharply opinionated petroleum geologist says most of the big oil repositories have been found, and no amount of gadgetry will restore bubbly youth to aging fields from Indonesia to the Gulf of Mexico. War, politics and soaring costs, he adds, are slowing development in many of the most promising regions.

"The fact is, we have to work harder and harder to get the oil we need," he says. Those who contend otherwise, he insists, "claim to have some magic potion, like voodoo, that doesn't exist."

Mr. Saleri, who is a year younger, shrugs off his former boss's pessimism. A self-described "technology nut" who resigned as Aramco's top reservoir manager last fall to set up his own consulting shop in Houston, Mr. Saleri has become a vociferous opponent of the "peak oil" view, which holds that global oil production is about to enter a permanent slump due to shrinking resources and limited investment. ...

By last fall, anxiety was growing within the industry and on Wall Street over whether long-term supplies could keep pace with the rising world demand. Mr. Husseini stoked those fears at a London conference in October. The major oil-producing nations were inflating their oil reserves by as much as 300 billion barrels, about one-quarter of the world's proven reserves, he said, while the giant fields of the Persian Gulf region are 41% depleted.

Mr. Saleri, who left Aramco in September, doesn't share those worries. He has hired a half dozen former Aramco and Chevron officials and opened a business in Houston. His company, Quantum Reservoir Impact, says it has the reservoir-modeling and management know-how to revive declining oil fields. Mr. Saleri is now shopping his services to big national oil companies in Latin America and the Middle East, though he has yet to sign any contracts.

In a Wall Street Journal opinion piece in March, he dismissed the peak-oil theory. "The world has plenty of oil," he wrote. Three weeks later, Mr. Husseini flew to New York at the invitation of a clutch of high-powered financiers, including Mr. Soros, Leucadia National Corp. Chairman Ian M. Cumming and Aubrey McClendon, the chief executive of natural-gas company Chesapeake Energy Corp.

The group of about 20 met for dinner in the 21 Club's wine cellar. Mr. Husseini declines to comment on the session. One guest says he spoke mainly about the geopolitical thunderclouds hovering over the oil market, especially the U.S. and Israeli standoff with Iran.

In a longer presentation the following morning, he argued that the world will have to work hard just to keep its oil production where it is. Conservation, not new oil discoveries, will be "the primary source of overall energy availability" going forward, he said.

He delivered the same message to oil magnate T. Boone Pickens over lunch in Chicago. "It was just two oil guys talking," says Mr. Pickens, adding that Mr. Husseini's views dovetail with his own.

Messrs. Husseini and Saleri remain collegial, though they haven't spoken for months. Both see the other's views as largely a matter of personal disposition.

"Sadad by nature sees the dark clouds overhead," says Mr. Saleri. "He's a pessimist."

His former boss laughs at the description. "The problem with Nansen," he says, "is that he loves his theories, even when they run up against reality."