Oil Price Fall Squeezing Economics Of New Projects

Posted by Big Gav in peak oil

The FT has an article noting that falling oil prices are making a number of planned new projects financially unviable - Oil price fall may squeeze project profitability.

Total, the French oil company, said on Thursday that oil prices had slipped to within sight of the threshold below which some of its most expensive projects will no longer be commercially viable.

Total’s extra heavy oil sands project in Canada requires an oil price of just below $90 a barrel to achieve a 12.5 per cent internal rate of return, while Total’s developments in the deep waters off Angola need about $70 a barrel, the company revealed in a mid-year presentation. International oil prices on Thursday traded at $102.10 on the New York Mercantile Exchange.

Chistophe de Margerie, Total’s chief executive, warned there was no space for a windfall tax: “It’s true that at $140 a barrel [oil prices] some people might consider there could be room for [windfall] taxes.”

He said that whatever the price, taxes were not a solution, but noted: “At $100 a barrel we need the money to train people and develop new energies, new discoveries, renewable energy and to tackle climate change.”

However, Richard Lines, head of petroleum economics at Wood Mackenzie, the industry consultants, said companies were making the same internal rate of return on big, capital intensive projects at $100 a barrel as they were four to five years ago at $40 because costs had risen so dramatically and fiscal terms deteriorated.

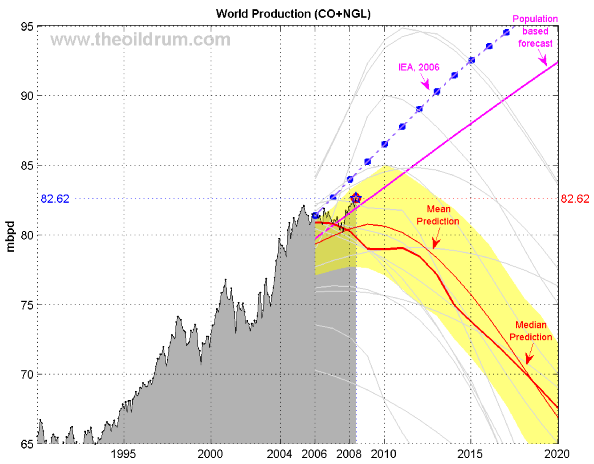

Khebab has his latest oil production numbers update up at The Oil Drum - Peak Oil Update - August 2008: Production Forecasts and EIA Oil Production Numbers.