The Triumph of CSM over UCG: Linc Flees To South Australia

Posted by Big Gav in coal seam gas, coal to liquids, csm, ctl, linc energy, ucg

The Courier Mail reports that Queensland's coal seam gas producers have succeeded in chasing underground coal gasification hopeful Linc Energy out of the state, with Linc deciding its coal to liquids technology might find the going easier in South Australia - Linc pulls out of Queensland $1b liquids plan, heads to SA. More at Bloomberg.

UNDERGROUND coal gasification hopeful Linc Energy has seen the writing on the wall in Queensland and will transfer plans for its $1 billion gas-to-liquids plant to South Australia.

For many years Linc has been planning a large UCG-GTL plant at Chinchilla in Queensland, where it has spent close to $50 million on a pilot liquids plant and a coal exploration program.

It was hoping to begin detailed designs next year on a commercial facility, eventually producing 20,000 barrels of diesel and aviation fuel a day just down the road from the pilot plant.

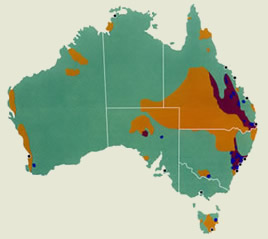

But Linc, which recently took over Adelaide-based energy hopeful Sapex to get access to its large coal exploration areas in SA's Arckaringa Basin, yesterday announced that instead it would "focus on developing its first commercial UCG-GTL operation in South Australia".

The announcement came a day after BG Group, which has just taken over coal seam gas group Queensland Gas Company, called on the Queensland Government to give coal seam gas companies, rather than UCG groups, priority over coal exploration areas in Queensland.

At present, coal exploration licences (used by UCG groups) and petroleum licences (which govern CSG development) can exist over the same resource.

BG chief executive Frank Chapman said his group's plans to spend as much as $15 billion on CSG development and LNG processing at Gladstone -- where Santos, Origin Energy and Arrow Energy and their international partners are also planning large multibillion-dollar LNG developments -- would have to be delayed unless BG could get guaranteed resource security.

Linc, QGC and Arrow Energy, have competing petroleum interests over part of the coal areas Linc holds near Chinchilla.

There was no news from the Queensland Government yesterday on BG's demands. A spokeswoman for Mines and Energy Minister Geoff Wilson said there had been no formal or informal contact recently with Linc about its UCG plans.

But CSG groups have lobbied the Government hard, raising questions about UCG's commercial credentials and its safety, particularly as it relates to potential water table pollution, with rural interests also chipping in on the latter question.

And in an August statement the department had no intention of granting production tenures for underground coal gasification for at least three years.

Meanwhile the SMH has an update on the CSG boom, predicting rising gas prices for the NSW market - It's boom time for Queensland coal-seam gas.

THE boom in eastern Australia's coal-seam gas industry will accelerate a rise in NSW gas prices, the national energy regulator says.

The State of the Energy Market 2008 report, to be published today, says the rush of projects to develop Queensland's coal-seam gas into an exportable liquidate form has already nudged up prices along the east coast, as producers seek higher returns.

A gigajoule of gas fetched $2.50-$2.90 two years ago but the report's lead essay by forecasters ACIL Tasman said recent sales in Queensland had peaked at $7.

Unlike electricity, gas markets outside of Victoria's are opaque and allow deals to be settled privately, leaving forecasts hazy. But the report said gas was regularly selling for above $4 a gigajoule, as producers seek "significantly higher prices".

Global oil powers have been attracted to converting Queensland's extensive reserves into liquefied natural gas (LNG), which can fetch much higher prices on global markets. No LNG plants have been suggested for NSW but prices are being forced up regardless.

Oil has fallen more than 60 per cent from its peak but the companies behind the multibillion-dollar LNG projects are confident of getting high prices despite the downturn.

"The fact that most of the major [coal-seam gas] producers are currently looking to boost reserves and production capacity to underpin proposed LNG facilities means that the supply surplus which had prevailed in the Queensland market for several years has now been reversed," it said.

Historically, Australians have had the world's cheapest gas. In the US, it costs about $US6.70 per million British thermal units, slightly less than a gigajoule. ...

Gas companies have long argued that prices are set to rise towards "export parity'. The report confirms the Queensland LNG plans are accelerating the process. Australia is the fifth largest LNG exporter. The coal-seam gas bonanza has seen the likes of ConocoPhillips in the US, Britain's BG Group and Malaysia's Petronas pay well above previous prices.