The cost of wind, the price of wind, the value of wind

Posted by Big Gav in wind power

Jerome a Paris has an excellent (and long) article at TOD about the economics of wind power - The cost of wind, the price of wind, the value of wind.

I'd like to try to clear some of the confusion that surrounds the economics of wind power, as it is often fed and used by the opponents of wind to dismiss it. As I noted recently, even the basic economics of energy markets are often wilfully misunderstood by commentators, so it's worth going in more detail through concepts like levelised cost and marginal cost, and identify how different electricity producers have different impacts on electricity (market) prices (which may or may not be reflected in retail prices) and have different externalities. Value for society of a generation source may also include other items that are harder to acount in purely monetary terms (and/or whose very value may be disputed), such as the long term risk of depletion of the fuel, or energy security issues, such as dependency on unstable and/or unfriendly foreign countries or vulnerable infrastructure.

Depending on which concept you favor, your preferred energy policies will be rather different. Follow me below the fold for a tour.

Costs

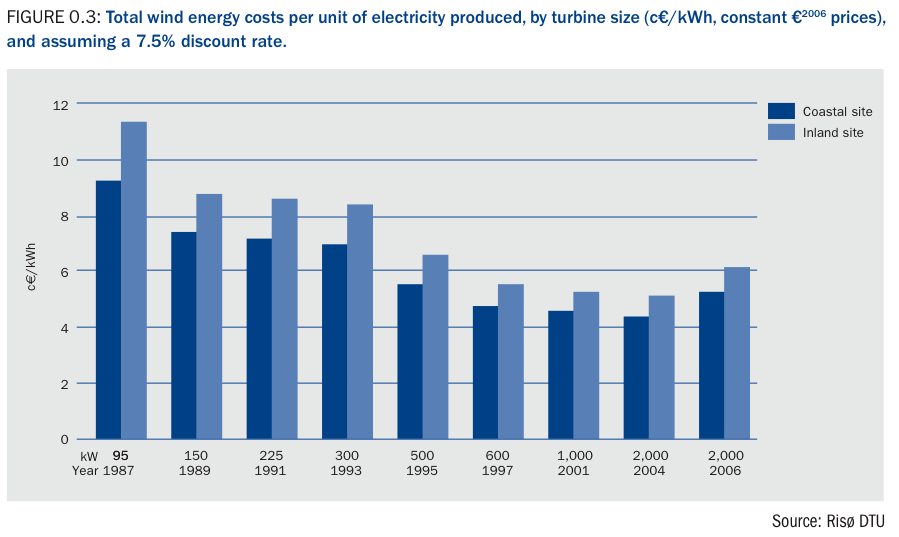

The cost of wind is, simply enough, what you actually need to spend to generate the electricity. The graph below shows how these costs have changed over the past decade: a long, slow decline as technology improved, followed, over the past 3 years, by an increase as the cost of commodities (in the case of wind, mainly steel) increased, and as strong demand for turbines allowed the manufacturers (or their subcontractors) to push up their prices: ...

A power plant is an investment that can last 25 to 50 years (or even more, in the case of dams). Once built, it will create patterns of behavior that will similarly last for a very long time. A gas-fired plant will require supply of gas for 25 years or more (and the corresponding infrastructure, and attached services, employees ... and lobbyists). Given worries about resource depletion (usually downplayed) and about the unreliability of some suppliers (hysterically exaggerated, cf the "New Cold War" hype about Putin's Russia), it is not unreasonable to suggest that security of supply has a cost.

This may be reflected in long term supply arrangements with firm commitments by gas-producing countries to deliver agreed volumes of gas over many years - but, given all the Russia-angst we hear, this does not seem to be enough (most supplies from Russia are under long term contracts). Wind, which requires no fuel, and thus no imports, neatly avoids that problem, but how can that be valued in economic terms? That question has no satisfactory reply today, but it is clear that the value is more than nil.

Another aspect of this is that "security of supply" is usually understood to mean "at reasonable prices." Fuel-fired power plants will need to buy gas or coal in 10, 15 or 20 years time and it is impossible today to hedge the corresponding price risk. Given prevalent pricing mechanisms, individual plants may not care so much (they will pass on fuel price increases to consumers), but consumers may not be so happy with the result. Again, here, wind, with its fixed price over many years, provides a very valuable alternative: a guarantee that its costs will not increase over time. Markets should theoretically be able to value this, but futures markets are not very liquid for durations beyond 5 years, and thus, in practice, they don't do it. This is where governments can step in, to provide a value today to the long term option embedded in wind (i.e. a "call" at a low price). This is what feed-in tariffs do, fundamentally, by setting a fixed price for wind production which is high enough for producers to be happy with their investment today, and low enough to provide a hedge against cost increases elsewhere in the system (and indeed, last year, when oil and gas prices were very high, feed-in tariffs in several countries ended up being below the prevailing wholesale price: the subsidy went the other way round...).

Note that the regulatory framework will decide who gets access to that value: if wind is sold at a fixed price, it is the buyer of that power that will benefit from the then-cheap supply (and that may be a private buyer under a PPA, or the grid operator; depending on regulatory mechanics, that benefit may be kept by that entity, or have to be reflected into retail tariffs for end consumers). If wind producers get support in the form of tax credits or "green certificates", it is wind producers that will capture the windfall of high power prices. So the question is not just how to make that value appear, but also how to share it. Both are political questions to which there are no obvious answers.

:: ::

So wind power has value as a low-emissions, home-grown, fixed cost supplier. It also tends to create significant numbers of largely non-offshoreable jobs, which may be an argument in today's context. It also has, in a market pricing mechanism, the effect of lowering prices for consumers thanks to its zero-marginal cost. Its drawbacks, i.e. mainly intermittency, can be priced and taken into account by the system. (Birds/bat are not a serious issue, despite the hype; esthetics are a very subjective issue which can usually be sidestepped by avoiding certain locations - the US is big enough, and Europe has the North Sea).Altogether, wind seems to be an excellent deal for consumers - and an obvious pain (in terms of both lower volumes, and lower prices) for competing sources of power, except maybe those specialising in on-demand capacity.

In other words: sticking with mostly coal or nuclear is a political choice, not an economic one.