Oil Industry Sets a Brisk Pace of New Discoveries ?

Posted by Big Gav in end of oil, new york times, peak oil, scientific american

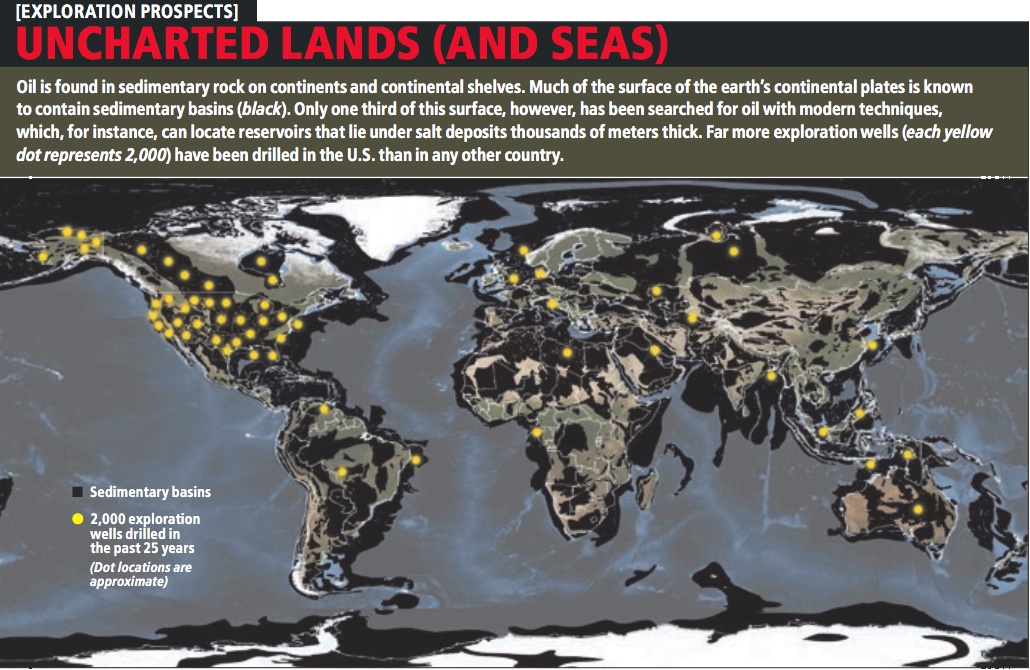

There have been a few articles in the mainstream media lately expressing skepticism about a near term peaking in oil production - the New York Times (Oil Industry Sets a Brisk Pace of New Discoveries) and Scientific American (Squeezing More Oil From The Ground) being prominent amongst them.

The oil industry has been on a hot streak this year, thanks to a series of major discoveries that have rekindled a sense of excitement across the petroleum sector, despite falling prices and a tough economy.

These discoveries, spanning five continents, are the result of hefty investments that began earlier in the decade when oil prices rose, and of new technologies that allow explorers to drill at greater depths and break tougher rocks.

“That’s the wonderful thing about price signals in a free market — it puts people in a better position to take more exploration risk,” said James T. Hackett, chairman and chief executive of Anadarko Petroleum.

More than 200 discoveries have been reported so far this year in dozens of countries, including northern Iraq’s Kurdish region, Australia, Israel, Iran, Brazil, Norway, Ghana and Russia. They have been made by international giants, like Exxon Mobil, but also by industry minnows, like Tullow Oil.

These claims are being buoyed by various announcements of reasonably large oil discoveries in new offshore locations, such as BP's Tiber find in the Gulf of Mexico, Iran's 8.8 billion barrel claim in Kouzestan, the Anadarko led discovery off West Africa and news that Cairn Energy have commenced production at a 1 billion barrel field in Rajastan, India (I'm not sure what large discoveries have been made in Australia recently however - as claimed in the NYT article - there is lots of news on the natural gas and coal seam gas fronts but little about oil).

Most of the commentary ignores the fact that these discoveries are much smaller than the really large fields discovered in the mid-20th century, and that the new offshore fields are very deep in comparison to earlier offshore oil discoveries, so exploiting them will be both time-consuming and costly - so they could be considered a vindication of peak oil theories rather than a refutation of them.

The flow of news hasn't been entirely one way though, with the FT noting that even with these new discoveries, "the finds may not be enough to ward off a supply crunch as the world economy recovers" - Oil strikes not enough to quench demand and Finding new oil gets ever more expensive - and the Independent having a balanced look at the issue - The Big Question: Does BP's discovery of a giant new field prove we're not running out of oil?.

It is worth bearing in mind not only that giant fields are the lifeblood of the industry, but that the overall rate of discovery is on a downward trend. The 20 largest oil fields – out of around 70,000 around the world – account for a quarter of all production; the largest, Ghawar, discovered in Saudi Arabia in 1948, is only halfway through its 140 billion barrels. But while in the Sixties around 56 billion barrels were being discovered each year, that fell to 13 billion in the Nineties. And most new discoveries are off-shore and under deep waters (where they are much more expensive to extract).

For those worried about recent shocks in the price of oil, and the global economy's extreme over-reliance on oil, the new discoveries are welcome relief. But they cannot disguise the fact that supply is generally declining as demand is generally growing. Their effect is only to delay the inevitable.

Heading Out at Bit Tooth Blog, Kurt Cobb at Energy Bulletin and Gail at The Oil Drum also have some commentary on the NYT and Scientific American articles.

The NYT hasn't become entirely skeptical about near term peak oil - the paper also has a review of Peter Maass’s new book, “Crude World: The Violent Twilight of Oil.” - The End of Oil ?.

The NYT hasn't become entirely skeptical about near term peak oil - the paper also has a review of Peter Maass’s new book, “Crude World: The Violent Twilight of Oil.” - The End of Oil ?.Oil is the curse of the modern world; it is “the devil’s excrement,” in the words of the former Venezuelan oil minister Juan Pablo Pérez Alfonzo, who is considered to be the father of OPEC and should know. Our insatiable need for oil has brought us global warming, Islamic fundamentalism and environmental depredation. It has turned the United States and China, the world’s biggest consumers of petroleum, into greedy, irresponsible addicts that can’t see beyond their next fix. With a few exceptions, like Norway and the United Arab Emirates, oil doesn’t even benefit the nations from which it is extracted. On the contrary: Most oil-rich states have been doomed to a seemingly permanent condition of kleptocracy by a few, poverty for the rest, chronic backwardness and, worst of all, the loss of a national soul.

We can’t be rid of the stuff soon enough.

Such is the message of Peter Maass’s slender but powerfully written new book, “Crude World: The Violent Twilight of Oil.” Unquestionably, by fueling better and faster transportation and powering cities and factories, oil has been critical to modern economies. But oil has also made possible the most destructive wars in history, and it has left human society in a historical cul-de-sac. Despite much hue and cry today, Maass argues, we seem unable to move beyond an oil-based global economy, and we are going to hit a wall soon.

Maass, a contributing writer for The New York Times Magazine, tends to endorse the predictions of industry skeptics like Matthew Simmons, who argues the earth is about to surpass “peak oil” supplies. Even with the recent fallback in prices, the petroleum that’s left to discover will be harder and more expensive to extract. Last year’s $147-a-barrel oil was just a “foretaste of what awaits us,” Maass writes.

Maass is less interested in crunching oil-supply numbers, however, than in exposing the cruelty and soullessness of humankind’s lust for this “violence-inducing intoxicant,” as he calls it. His book teaches us an old lesson anew: that the true wealth of nations is not discovered in the ground, but created by the ingenuity and sweat of citizens. It’s the same lesson the Spanish learned centuries ago when they discovered gold, the oil of their time, in the New World. They piled up bullion but squandered it on imperial fantasies and failed to build enduring prosperity, while destroying the civilizations from which they seized it.