New Energy Report from Harvard Makes Unsupportable Assumptions

Posted by Big Gav in peak oil

The Oil Drum has a post looking at the paper from Leonardo Maugeri that prompted George Monbiot's strange about face on peak oil - New Energy Report from Harvard Makes Unsupportable Assumptions.

As for US production, this is tied to increasing production from all the oil shales in the country, which will see spurts in growth similar to that seen in the Bakken and Eagle Ford.I estimate that additional unrestricted production from shale/tight oil might reach 6.6 mbd by 2020, or an additional adjusted production of 4.1 mbd after considering risk factors (by comparison, U.S. shale/tight oil production was about 800,000 bd in December 2011). To these figures, I added an unrestricted additional production of 1 mbd from sources other than shale oil that I reduced by 40 percent considering risks, thus obtaining a 0.6 mbd in terms of additional adjusted production by 2020. In particular, I am more confident than others on the prospects of a faster-than-expected recovery of offshore drilling in the Gulf of Mexico after the Deepwater Horizon disaster in 2010.As I noted in my review of the Citicorp report this optimism flies in the face of the views of the DMR in North Dakota – who ought to know, since they have the data. The report further seems a little confused on how horizontal wells work in these reservoirs. As Aramco has noted, one cannot keep drilling longer and longer holes and expect the well production to double with that increase in length. Because of the need to maintain differential pressures between the reservoir and the well, there are optimal lengths for any given formation. And as I have also noted, the report flies in the face of the data on field production from the deeper wells of the Gulf of Mexico.It seems pertinent to close with the report’s list of assumptions on which the gain in oil production from the Bakken is based:

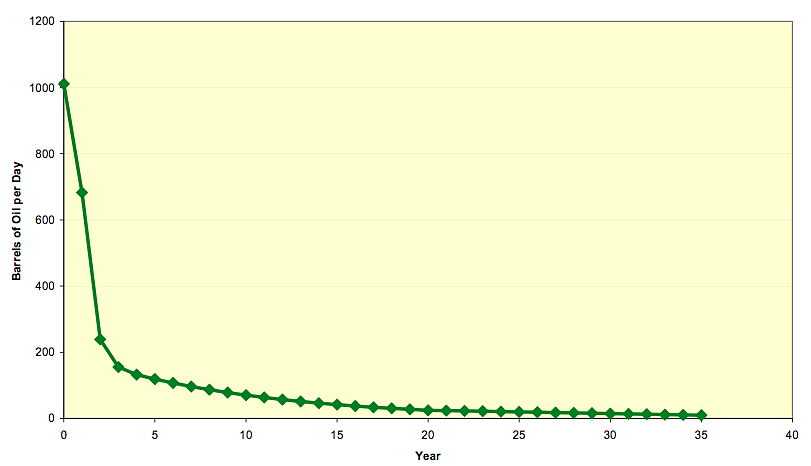

* A price of oil (WTI) equal to or greater than $ 70 per barrel through 2020Enough, already! There are too many unrealistic assumptions to make this worth spending more time on. To illustrate but one of the critical points - this is the graph that I have shown in earlier posts of the decline rate of a typical well in the Bakken. You can clearly see that the decline rate is much steeper than 15% in the first five years.* A constant 200 drilling rigs per week;

* An estimated ultimate recovery rate of 10 percent per individual producing well (which in most cases has already been exceeded) and for the overall formation;

* An OOP calculated on the basis of less than half the mean figure of Price’s 1999 assessment (413 billion barrels of OOP, 100 billion of proven reserves, including Three Forks).

Consequently, I expect 300 billion barrels of OOP and 45 billion of proven oil reserves, including Three Forks;

* A combined average depletion rate for each producing well of 15 percent over the first five years, followed by a 7 percent depletion rate;

* A level of porosity and permeability of the Bakken/Three Forks formation derived from those experienced so far by oil companies engaged in the area.

Based on these assumptions, my simulation yields an additional unrestricted oil production from the Bakken and Three Forks plays of around 2.5 mbd by 2020, leading to a total unrestricted production of more than 3 mbd by 2020.