Losing friends with an expanding natural gas export sector

Posted by Big Gav in australia, coal seam gas, lng, natural gas

The Business Spectator has a look at the downside of Australia's expanding natural gas / coal seam gas export sector - Losing friends with an expanding gas export sector. When exports of shale gas start from the US I imagine a similar debate will start up there - cheap gas only lasts as long as you aren't exposed to global markets.

The export gas multinationals are no friend of Australian manufacturing. There is only one reason that the gas prices are set to at least double over the next few years – gas export companies will force Australian consumers to compete with the Asian market for gas.That’s the true cost of opening up coal seam gas mining and allowing gas from eastern Australia to be exported. And no amount of drilling for more CSG will either secure the gas for domestic users or keep the price down. The simple reason for this is that no matter how much gas is found, it can all be exported.

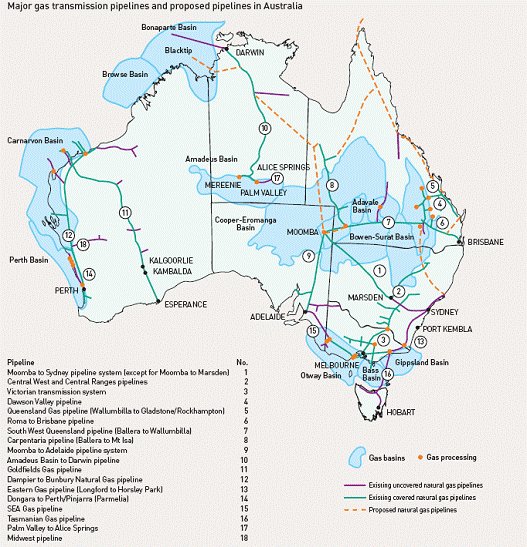

The gas export terminals currently under construction will have a massive capacity of 1637 petajoules. That’s more than double all the gas we use in Australia at the moment. But according to analysis done by Core Energy for the Australian Energy Market Operator, there are over 6000 petajoules of additional proposed LNG export facilities, enough to quadruple the export capacity currently under construction. These include several additional liquefied natural gas 'trains' at the existing Curtis Island facilities in Gladstone and new facilities at existing ports in Queensland and New South Wales.

The Australia Institute recently used AEMO gas demand and price projections to calculate the increased cost of gas to the manufacturing industry in the Gladstone region as a result of CSG exports. It found a massive cost of $2.9 billion over the next 10 years, to be paid by just a handful of manufacturers.

This is threatening the viability of these industries. We are effectively allowing multinational gas exporters to displace our manufacturing sector. And it’s not just as a result of the gas price. The gas expansion is also displacing manufacturing by keeping the Australian dollar higher than it would otherwise be, and creating a severe skills shortage.