The Economist on The future of oil

Posted by Big Gav in oil, peak oil, renewable energy

The Economist has a special report on energy, looking at how to break the oil habit - The future of oil.

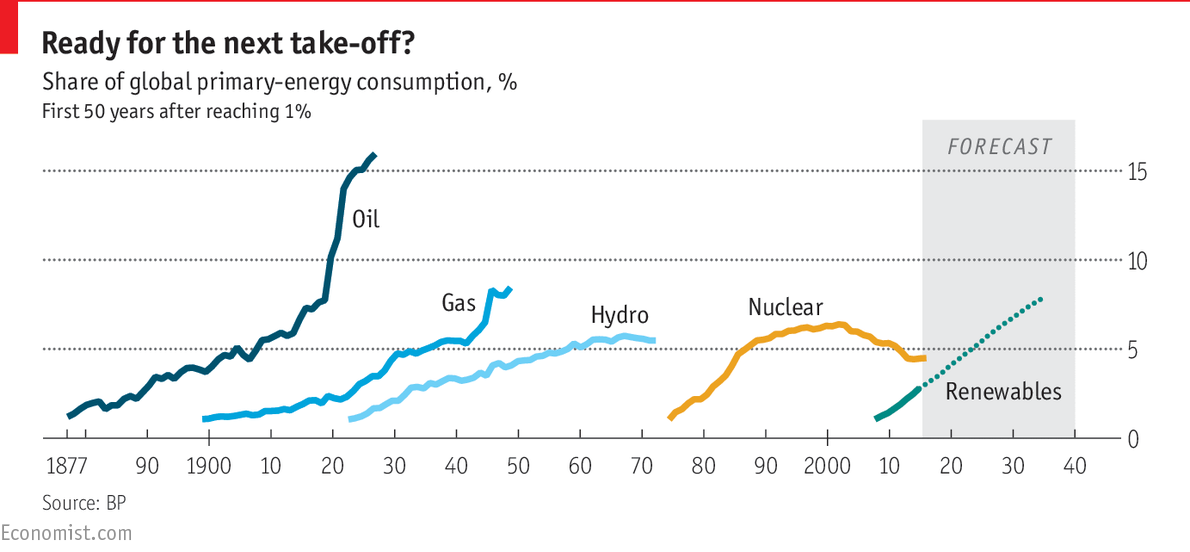

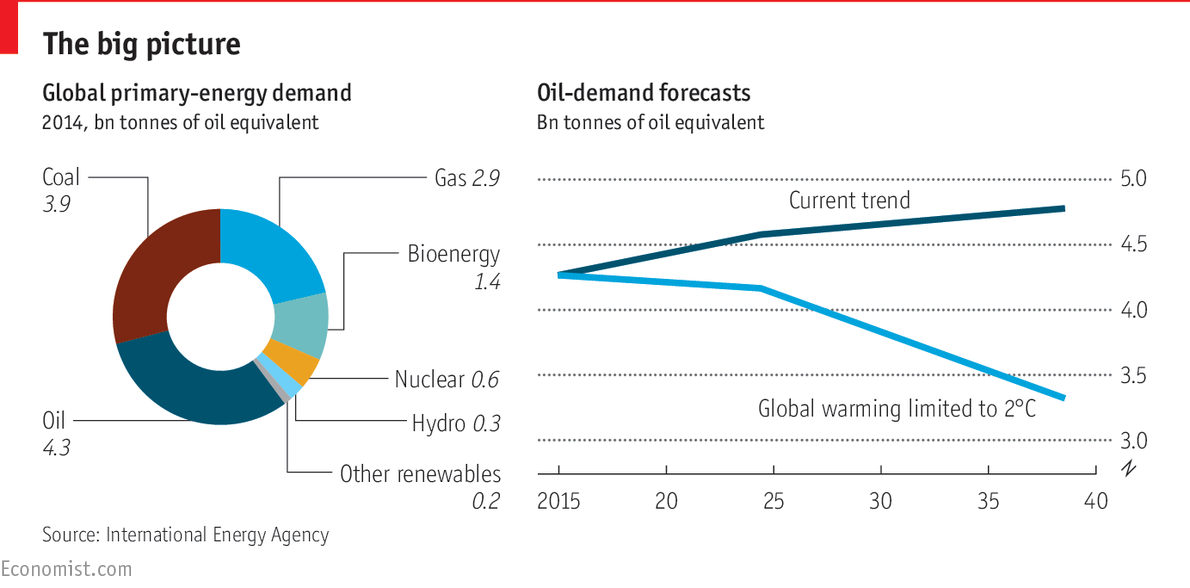

For all its staying power, oil may be facing its Model T moment. The danger is not an imminent collapse in demand but the start of a shift in investment strategies away from finding new sources of oil to finding alternatives to it. The immediate catalyst is the global response to climate change. An agreement in Paris last year that offers a 50/50 chance of keeping global warming to less than 2ºC above pre-industrial levels, and perhaps limiting it to 1.5ºC, was seen by some as a declaration of war against fossil fuels.The International Energy Agency (IEA), a global forecaster, says that to come close to a 2ºC target, oil demand would have to peak in 2020 at 93m barrels per day (b/d), just above current levels. Oil use in passenger transport and freight would plummet over the next 25 years, to be replaced by electricity, natural gas and biofuels. None of the signatories to the Paris accord has pledged such draconian action yet, but as the costs of renewable energy and batteries fall, such a transition appears ever more inevitable. “Whether or not you believe in climate change, an unstoppable shift away from coal and oil towards lower-carbon fuels is under way, which will ultimately bring about an end to the oil age,” says Bernstein, an investment-research firm.

Few doubt that the fossil fuel which will suffer most from this transition is coal. In 2014 it generated 46% of the world’s fuel-based carbon-dioxide emissions, compared with 34% for oil and 20% for natural gas. Natural gas is likely to be the last fossil fuel to remain standing, because of its relative cleanliness. Many see electricity powered by gas and renewables as the first step in an overhaul of the global energy system.

This special report will focus on oil because it is the biggest single component of the energy industry and the world’s most traded commodity, with about $1.5trn-worth exported each year. Half of the Global Fortune 500’s top ten listed companies produce oil, and unlisted Saudi Aramco dwarfs them all. Oil bankrolls countries that bring stability to global geopolitics as well as those in the grip of tyrants and terrorists. And its products fuel 93% of the world’s transport, so its price affects almost everyone.

Another article in the report looks out into the post oil future - When oil is no longer in demand.

As the world enters what could be the twilight of the oil age, some wonder whether Aberdeen’s travails could be a harbinger of things to come in oil-producing regions across the world. Mr Spence thinks so. He still runs the smartest hotel in Aberdeen and is about to install a charging station for electric vehicles. ...Statoil, the Norwegian state oil company, has set an example of what oil companies might do in future. Earlier this year it acquired a lease to build the world’s largest floating wind farm 15 miles off the coast of Peterhead, north of Aberdeen. Each of its five 6MW turbines will be tethered to the seabed on a floating steel base, enabling it to operate in deeper water than a conventional turbine embedded into the sea floor. That will give it access to stronger winds farther offshore, making it cheaper to produce electricity.