Offshore Wind at an Affordable Price

Posted by Big Gav in energy, offshore, power, wind

EcoGeek reports that offshore wind farm technology is using a few ideas from the oil industry for building platforms that work far offshore- "Offshore Wind at an Affordable Price".

Offshore wind is a relatively underexploited resource, with obstacles ranging from Cape Wind-like NIMBYism to the high infrastructure costs (and thus total costs) for installing systems out at sea. The idea of going toward floating wind turbines has been around awhile and Blue H Group looks to be one step closer to making that idea a reality.

Blue H offshore wind farms are planned to be far out at sea, virtually invisible to the naked eye from shore. At such locations, the winds are stronger and are more constant, ideal for generating large quantities of clean and inexhaustible electricity.

Rather than installing the wind turbine foundations to literally be built into the seabed, however deep it might be, Blue H is "adapting the concept of submerged tension-legged platforms developed by the oil industry ... and designed a platform large and stable enough to support a tower and a wind turbine."

According to Blue H, the Submerged Deepwater Platform (SDP) technology:

* Reduces the overall weight of the structure (claiming a 60+% total reduction for a 5 mw system, from 2100 to 800 tons)

* Can be built onshore / in a port and towed into place, 10 miles or more offshore in deep waters (more than 50 meters in depth), reducing the specialty requirements for heavy equipment like crane ships.

* Enables placing the wind turbines/farms far enough offshore to minimize NIMBYism and to be able to getting even better wind

* Can be dismantled/moved with little environmental impact

If this works, this suggests a path toward rapid ramping up of offshore wind at affordable costs.

Jerome a Paris also has a post on offshore wind at The Oil Drum.

Just over 900MW of offshore wind had been built by end 2006 (compared to 74,000 MW onshore), but the plan is to get to 40,000 MW of offshore wind in Europe by 2020, with approximately half in the UK, a quarter in Germany and the rest spread across Europe, mostly in the North Sea (which has good winds and shallow waters).

The industry, like others, has suffered from rapidly increasing costs in recent times, from increased commodity prices, overstretched suppliers and, it must be said, still unresolved technical difficulties with some turbine models that have been withdrawn from the market after encountering technical difficulties. There is a lot of focus on reaching a scale sufficient to rationalise and standardise both manufacturing and offshore installation, after the early years of projects designed on a case-by-case basis.

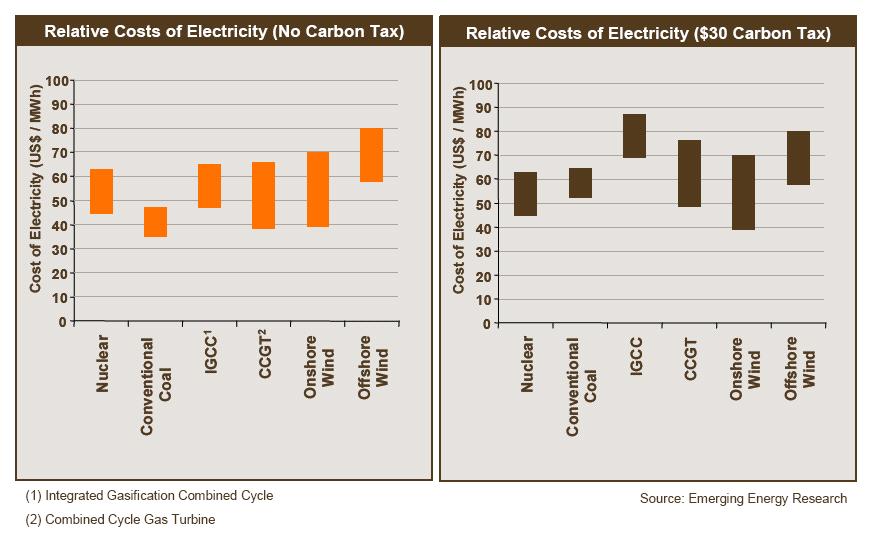

The graph below reflects costs prior to commodity increases - but these apply equally to other sectors, so all technologies are more expensive today. The great advantage of wind in that respect, of course, is that once it is built, the cost is fixed: you only have to repay the initial investment, a fixed amount, and not to buy fuel, whether coal, natural gas or oil, whose prices can also increase - and indeed have. And an other overlooked advantage is that wind's marginal cost (the cost of production of an additional kWh) is close to zero, so whenever wind blows, this takes out more expensive producers and reduces prices for everybody. In fact, a Danish study has demonstrated that the resulting savings for that country are now larger than the subsidies provided to wind...

Even if it is unreliable due to its intermittency, wind still has a real effect on both electricity prices as well as on carbon emissions, as each kWh of wind will usually displace a marginal kWh generated by a gas or oil-fired plant.

Offshore wind is still more expensive than onshore (thus the need for additional support in the early years of this new industry), but it responds to the fact that Europe is quite small and densely packed, and some areas will not be able to take more wind turbines, especially the huge models now available, which tower more than a hundred meters above ground. With winds at sea being stronger and more regular, it is the obvious place to put industrial size wind farms, and the hope is that economies of scale will eventually make it cost effective (it is already competitive compared to gas-fired power, given natural gas prices) - and of course, that production that can be scaled to levels that allow the sector to represent a significant fraction of total energy production. The European goal for 2020, 20% of all energy from renewable sources is quite ambitious, as it means that more than 20% of all electricity should come from wind by then.

Another obvious trend was how the industry is now dominated by the large players, in particular on the investor side - the business is essentially run by the big utilities, with a few independent developers remaining (and those that have good prospects are usually take-over targets for the bigger players right now). On the manufacturing side, the presence in the business of GE (currently absent from offshore as they have no appropriate turbine, their 3.6MW model having shown unsufficiently reliable performance), French nuclear energy giant Areva (via Multibrid, still in the early stages of integration), German engineering group Siemens (the dominant player offshore) shows that concentration is well under way, and the fate of Vestas (still the largest wind turbine manufacturer overall, but a small company compared to the big indistrial groups) and Repower (focused on offshore, but whose main shareholder, Indian-based Suzlon, is itself a pure wind player and thus quite small as well) will certainly become a hot issue in the future.

Offshore wind is heavy industry: a nacelle weights 100-300 tons, a blade is 50 meters long, a tower is 80 meter high, etc... Managing 20-30% p.a. growth rates in heavy industry is extremely hard to do - logistics, supply chains and financial commitments are complex, and a wrong bet on where demand will be (on the high or on the low side) can have devastating consequences.

Offshore wind is less urgent in the US than it is in Europe, as there is still plenty of room onshore to grow (and with a much better wind resource than in Europe) and thus less need to pay the higher cost of offshore, but there could be some projects in areas like the Great Lakes or in the densely populated North-East.

In any case, there is no silver bullet, and wind (and a fortiori offshore wind) is not by any means the only solution. But today, it is the technology with the best prospects to have a real impact on our carbon emissions, at a low economic cost, and with very real positive effects on overall employment, redevelopment of isolated areas, and security of supply.

Wind is free, clean, indigenous, and available today.

The Independent has an article on the European "supergrid" idea (just one component in the future global energy grid) fed by large scale renewable energy sources - "Has Europe Found a Way To Replace Fossil Fuels?".

An audacious proposal to build a 5,000-mile electricity supergrid, stretching from Siberia to Morocco and Egypt to Iceland, would slash Europe's CO2 emissions by a quarter, scientists say.

The scheme would make the use of renewable energy, particularly wind power, so reliable and cheap that it would replace fossil fuels on an unprecedented scale, serving 1.1 billion people in 50 countries. Europe's 1.25bn tons of annual CO2 output from electricity generation would be wiped out. High-voltage direct current (HVDC) lines, up to 100 times as long as the alternating current (AC) cables carried by the National Grid's pylons, would form the system's main arteries. While AC lines are the international standard, they leak energy. HVDC lines are three times as efficient, making them cost effective over distances above 50 miles.

Building the supergrid would require an investment of $80bn (£40bn), plus the cost of the wind turbines -- a fraction of the €1 trillion the EU expects to pay for a 20 percent reduction of its carbon footprint by 2020. The average price of the electricity generated would be just 4.6 euro cents per kWh, competitive with today's rates, which are likely to rise as fossil fuels run out.

Yet while several governments have expressed interest, Britain is not among them, says the scientist behind the proposal. "We have the technical abilities to build such a supergrid within three to five years," said Dr Gregor Czisch, an energy systems expert at the University of Kassel in Germany. "We just need to commit to this big long-term strategy."

Many supporters of renewable energy see it as a small-scale technology, but Dr Gordon Edge of the British Wind Energy Association, said the megaproject was essential. "European policy is only just waking up to this," he said.

The supergrid would draw power from massed turbines in a band of countries to Europe's south and east that have above average wind potential, feeding it to the industrialised centres of Europe. The scale would overcome the biggest obstacle to wind power -- its unreliability. In smaller networks, such as Britain's National Grid, calm weather could cut production to zero. But the supergrid would cover a region so large that the wind would always be blowing somewhere.

TreeHugger has a post ion a new variation of solar PV concentrators - "Inflatable Solar: Coolearth Concentrated Photovoltaics"

Inflatable solar? It’s not the first time we’ve come across the idea. But according to Coolearth Solar, they’ve patented a design for inflatable solar collectors that are supposedly a cheaper way to concentrate sunlight onto photovoltaic cells. The makers claim their design is up to 400 times cheaper than polished aluminum mirrors which, if true, would certainly improve the economics of concentrated photovoltaics. Maybe they can team up with the makers of the inflatable car.

TreeHugger also has a post on efforts to harness ocean currents offshore from the gulf stream - "Gulf Stream's Tidal Energy Could Provide Up to a Third of Florida's Power".

As solar, wind and other renewable energy technologies increasingly become seen as viable alternatives to coal- and fossil fuel-based ones, some scientists are already looking beyond recent breakthroughs in these areas to the vast, largely untapped potential offered by the world's oceans. This follows a recent announcement by Secretary of the Interior Dirk Kempthorne clearing the way for further research and investment into wind, wave and tidal technologies on the U.S.'s Outer Continental Shelf.

Rick Driscoll, director of Florida Atlantic University's Center of Excellence in Ocean Energy Technology (CEOET), and his colleagues are hard at work developing a device that could allow his state to procure up to a third of its energy needs by tapping into the Gulf Stream's energy-dense waters. A field of underwater turbines moored 1,000 ft below the surface in the center of the Gulf Stream could - by drawing from its 8 billion gallons per minute flow rate - provide as much energy as several nuclear plants. ...

The big energy pay-off, however, may yet lie in another source that has caught Driscoll's eye - ocean thermal energy, which used to produce electricity by tapping into the temperature difference between cold deep water and warm surface water. "That ocean thermal resource is probably the largest renewable energy source available anywhere," he said.

Phil Hart at The Oil Drum (ANZ) has an interesting post (if you're a peak oil wonk) on the USGS's calculation of future growth in oil reserves from already discoevered fields - "Shedding Light on the Question of Reserves Growth"

In 2000, the United States Geological Survey issued its World Petroleum Assessment, covering the thirty year period 1995-2025. The resource estimates from this study are widely quoted to support the argument that oil production can continue to expand. In assessing the world's total oil endowment to be over 3 trillion barrels, the USGS study defines a huge contribution of 730 billion barrels with the 'potential to be added' to world reserves over the period 1995-2025 as a result of increases in the amount of oil that can be extracted from existing fields. The complete Reserves Growth report (Chapter RG) from the World Petroleum Assessment is available through the USGS website.

It should be noted, that while the USGS total estimate is likely high in each of the three areas assessed, a total endowment of 3.3 trillion barrels is insufficient to enable production to continue growing at historical rates beyond 2020. Forecasts for peak oil occurring much beyond 2020 imply even more unlikely resource estimates. ...

Clearly the total figure here of 220 billion barrels has limited potential to delay peak oil, compared to the more significant 730 billion barrels suggested by the USGS. The weight that other commentators have given to 'reserves growth' in meeting future production needs implies even higher figures which seem unrealistic.

The estimates presented in Table 2 are necessarily approximate but dramatically improve on the simple and inappropriate extrapolation used by the USGS. Input to refine the figures is welcome; both in terms of the growth possible in each category and the volume of reserves allocated to each category.

As a final note, the USGS estimate of 730 billion barrels of reserve growth over the thirty year study period describes an annual reserves increase of 2.5%. Internal company estimates of annual growth in field reserves are closer to 0.2%. The USGS result is ten times higher than that used within the industry and must be called into question. I hope that this post provides new methodology for which the contribution to be made by reserves growth can be estimated.

The New York Times has an article expounding something like Jeffrey Brown's "export land" theory of peak oil - "Oil-Rich Nations Use More Energy, Cutting Exports".

The economies of many big oil-exporting countries are growing so fast that their need for energy within their borders is crimping how much they can sell abroad, adding new strains to the global oil market.

Experts say the sharp growth, if it continues, means several of the world’s most important suppliers may need to start importing oil within a decade to power all the new cars, houses and businesses they are buying and creating with their oil wealth.

Indonesia has already made this flip. By some projections, the same thing could happen within five years to Mexico, the No. 2 source of foreign oil for the United States, and soon after that to Iran, the world’s fourth-largest exporter. In some cases, the governments of these countries subsidize gasoline heavily for their citizens, selling it for as little as 7 cents a gallon, a practice that industry experts say fosters wasteful habits.

“It is a very serious threat that a lot of major exporters that we count on today for international oil supply are no longer going to be net exporters any more in 5 to 10 years,” said Amy Myers Jaffe, an oil analyst at Rice University.

Rising internal demand may offset 40 percent of the increase in Saudi oil production between now and 2010, while more than half the projected decline in Iranian exports will be caused by internal consumption, said a recent report by CIBC World Markets.

Business Intelligence reports that Saudi Arabia doesn't appear to be doing too much drilling in the existing Ghawar field - "Satellite images contradict Saudi peak oil theory says Bernstein Research". Maybe its not twilight in the desert just yet.

Satellite images may scuttle theories that the world's biggest oil field in Saudi Arabia is in decline, Bernstein Research said on Wednesday. A jump in drilling activity in recent years at the giant Ghawar oil field has raised concerns Saudi Arabia is struggling to maintain oil output and has fueled "peak oil" theories that global production is poised for a collapse.

But satellite images show that much of the rise in drilling activity has centered on two major expansion developments by state oil firm Saudi Aramco, instead of on keeping older parts of the field producing with enhanced recovery techniques, Bernstein said in a research note. "The majority of the increased activity in the Ghawar field can be explained by the Haradh-III, and the Hawiyah natural gas liquids recovery mega-projects which were not designed as a quick fix to Ghawar's supposed rapid decline," the note said.

Bernstein said the report was an initial analysis of satellite data from 2004-2007, with a final conclusion expected in the coming months.

The Nation has an article on "Ron Paul's Roots" which is an interesting little analysis of some of the different schools of thought with libertarian politics in the US.

Although not a single vote has been cast, it's safe to say that Ron Paul has run the most successful libertarian presidential campaign in American history. Sure, the Libertarian Party nominates a candidate every term, but said candidate struggles to garner money and media attention. Paul, however, has become a legitimate phenomenon, if not a particularly likely GOP nominee. With his full-throated rejection of the imperial project in Iraq and a radical vision of a stripped-down state (though, oddly, one that still forces pregnancy), he's attracting large crowds at campaign events and polling at a healthy 8 percent in New Hampshire. In November he broke the single-day fundraising record with a $4.2 million haul.

So you would think that the circle of DC-based libertarians centered around the Cato Institute would be ecstatic. Not quite. "He doesn't strike me as the kind of person that's tapping into those elements of American public opinion that might lead towards a sustainable move in the libertarian direction," says Cato vice president for research Brink Lindsey.

Self-identified libertarians may be a tiny portion of the electorate, but small numbers have never stood in the way of bitter intramural sectarian disputes. When Lindsey says that Paul "comes from a different part of the libertarian universe than I do," he's referring to the libertarian version of the Trotsky/Lenin split, which opened up in the early 1980s and continues to echo through libertarianism today.

In 1981 American libertarianism's founding father, Murray Rothbard, had a falling out with Cato leaders over their weak-kneed conception of libertarianism as "low tax liberalism." After being kicked off the board of the organization he had helped found, Rothbard, a Jewish, Bronx-born economist who'd studied with Austrian economist Ludwig von Mises, helped found the Mises Institute in Auburn, Alabama. The institute became the intellectual center for what Rothbard protégé Lew Rockwell termed "paleolibertarianism," a worldview rooted squarely in the populist Old Right tradition. Paleolibertarians tend to be culturally conservative (attracting, on the edges, a fair share of Confederacy nostalgists and white supremacists), nationalistically oriented and zealously against imperial foreign policy and the Federal Reserve. "Ron Paul has shown that the core of the state is the Pentagon and the Federal Reserve," says Rockwell, who was Paul's Congressional chief of staff from 1978 to 1982.

The division between paleolibertarians, centered around the Mises Institute, and cosmopolitan libertarians, centered around Cato, is also a case of "culture clash," according to Justin Raimondo, editorial director of Antiwar.com and prominent member of the Mises set. "There's the populist wing of the libertarian movement, and then there's the Washington crowd that's still trying to sell libertarianism, or their version of it, to elites. These people want to go along and get along. As long as they can abort their babies and sodomize each other and take as many drugs as they want to, they are happy. They don't care who is being killed in Iraq and how many Iraqis are dying. That's their hierarchy of values."

As you can tell, there's no love lost between the two camps. ... But nothing breeds harmony like success, and the Paul bandwagon is now getting big enough for both the Hatfields and the McCoys to get on board. "Our readership is very enthusiastic," says Nick Gillespie, editor of the DC-based magazine Reason. A few months ago Reason published an article titled "Is He Good for the Libertarians?" That no longer seems an open question. "On basic fundamental issues he speaks strongly for libertarians, regardless of the flavoring," says Gillespie, who recently co-wrote a pro-Paul op-ed in the Washington Post.

This gets to the paradox at the heart of the Paul campaign: he's the candidate least likely to hedge or obfuscate, the most apt to spell out in sharp detail his underlying principles--and yet he's also something of an ideological cipher, attracting the support of everyone from hipstertarian kids on Northeast college campuses to John Birchers in Texas. "You have this weird group of people," says Lindsey. "You've got libertarians, you've got antiwar types and you've got nationalists and xenophobes. I'm not sure that is leading anywhere. I think he's a sui generis type of guy who's cobbling together some irreconcilable constituencies, many of which are backward-looking rather than forward-looking."

But even if the Paul campaign doesn't point the way toward some lasting, powerful, paleo-cosmo libertarian coalition ... he is at least providing libertarians with a long-awaited Kumbaya moment. "There are personal animosities that will probably never heal," says Raimondo. "But, you know, maybe Ron Paul can unite us all."

Links:

* The Oil Drum - Fatih Birol Presents the IEA World Energy Outlook 2007

* Resource Investor - Peak Oil Passnotes: Where Will Crude Oil Be at Christmas Time?

* Energy Tech Stocks - In 2008, Investors Should Expect to be Buffeted by Oil Price Uncertainty - But One Fact Can’t be Denied

* Reuters - Iran stops selling oil in U.S. dollars

* EcoGeek - Two Cars that Could Get 80 MPG Years Ago

* Canada.com - Gas-gobbling bug could be a weapon against global warming

* MSNBC - Climate experts declare: 'No time to lose'. Dozen cross the line into policy by signing statement at U.N. talks

* Grist - Belief vs. knowledge: WSJ launches Luddite attack on climate scientists and Al Gore

* Past Peak - Do The Math

* Digby - Noble Neocons

* Raw Story - Sean Penn endorses Kucinich, challenges 'conventional wisdom' on electability

* Long Island News - Presidential Candidate Ron Paul Bears Empty Pot For Americans

* Glenn Greenwald - "Missing" evidence is familiar Bush pattern

* Daily Kos - It's Not Torture They're Covering Up, It's the Results

* Free Energy News - Free-Energy Battery Inventor Killed at Airport?.

* Funtasticus - Best Reuters Photos Of The Year