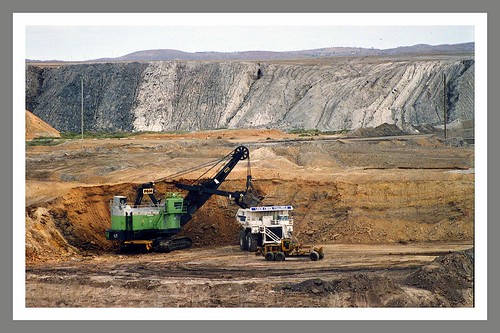

Riding On The Back Of A Coal Truck

Posted by Big Gav in australia, coal, economy

I was complaining about the "Australian disease" in my post about coal to liquids last week, as it became clear just how much King Coal is coming to dominate the local economy.

Ross Gittens can see the sunny side of this though, as he idly contemplates the de-industrialisation of the economy and the transformation of the nation into a giant quarry in "Everything's coming up roses", in which he predicts that we'll be "riding on the back of a coal truck" for the next few decades.

Global warming apparently isn't a problem in his eyes - or at least not one that people will bother to try and mitigate by burning less coal.

Powerful forces are at work that most of us are only dimly aware of. They will persist despite any economic slowdown and change the face of our economy.

The re-emergence of China and India as major economic powers is changing the structure of the world economy. These are the two most populous countries - accounting for almost 40 per cent of the globe's population - and when they start growing strongly and treading the well-trodden path of economic development they make a big difference.

Until now, the world economy has been growing unusually strongly. But get this: last year the United States, Europe and Japan accounted for only about 20 per cent of the growth in gross world product, whereas China and India - with help from Russia and Brazil - accounted for more than 40 per cent of that growth.

China is doing more than just churning out loads of cheap exports. It's busy turning a backward, rural economy into a modern industrial economy that will eventually yield its citizens a standard of living in the same ballpark as ours.

It's in the process of catching up with the developed world, achieving in the space of, say, 50 years what took the West 200 years. That's possible because of infusions of developed-country capital and, more importantly, technology.

This rapid development involves humungous expenditure on all the things we take for granted: roads, railways, bridges, power stations, housing and much else. This, in turn, requires huge quantities of energy and raw materials.

Among many other resources, China is consuming well over a third of the world's annual production of coal and iron ore. But China has a relatively low endowment of natural resources per person.

This is where we come in, of course. Australia accounts for about half the world's annual production of coking coal (for making steel) and about a fifth of the world's production of steaming coal (for generating electricity) and iron ore.

Rural and mineral commodities have always dominated our exports. The prices the world pays for those commodities vary greatly from year to year according to the vagaries of world demand and supply. In consequence, we've enjoyed "commodity booms" - periods of high world commodity prices - roughly every 20 or 30 years.

The present resources boom is probably the biggest we've ever experienced. The contract prices we receive for coal are expected to almost triple this year, with prices for iron ore leaping by a paltry 65 per cent.

Here's the point: unlike every other, fleeting commodity boom we've experienced, this one is likely to be permanent. Why? Because it's produced not by a temporary surge in the developed countries' demand for commodities, but by the industrialisation of the Chinese and Indian economies, a process that's likely to last for several decades.

Coal and iron ore prices will eventually fall back from their present sky-high levels, of course. But not until we and our competitor countries have greatly increased our production of those commodities. And even when they've fallen, prices are likely to remain much higher than they were.

See what this means? Throughout most of last century we watched the relative prices of our primary commodity exports steadily decline. The stuff we had to sell the developed world constituted an ever-diminishing share of its needs. We were backing a loser.

But with the development of China, India and other emerging economies, commodity-exporting countries like us are back on top. The stuff we've got to sell is now in great and continuing demand. We've returned to riding on the back of a coal truck.

This is great news. As a nation we're now a lot richer than we thought we were and can enjoy a significantly higher standard of living.

(The news will, however, discomfort people who're convincing themselves it's a sin to sell coal and those who imagine global warming will somehow halt the poor countries' economic development. Remember that most of what we're selling the Chinese goes to make steel, not electricity.)

But just as the re-emergence of China and India is changing the structure of the world economy, so our part in that re-emergence will change the structure of our economy - in ways many people won't like.

This restoration of Australia's comparative advantage in mining will require us to shift resources out of other industries and into mining. Our manufacturers are likely to be first in the firing line, although inbound tourism will also take a hit. Our soaring dollar will stay high as part of the pressure on these industries to contract.

For readers overseas who don't understand the coal truck reference, traditionally (back in the day when the country was just a giant sheep farm that supplied raw materials for British textile mills) the Australian economy was described as "riding on the sheep's back".