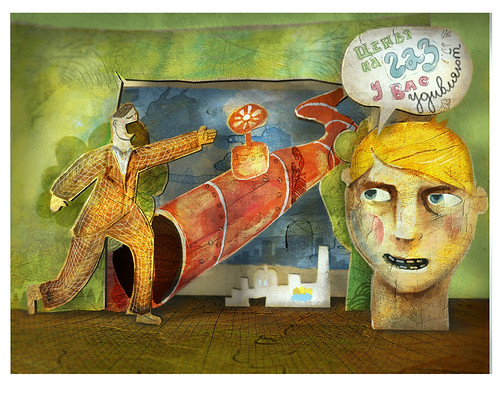

China Finds There Is No Cheap Gas From Gazprom

Posted by Big Gav in china, gas, gazprom, lng

The Asia Times has an interesting report on Chinese difficulties in obtaining gas at a price they like - with Gazprom proving just as eager as LNG exporters to lock in high prices.

China is a power behind global commodity flows as well as prices. But Beijing has been slow to understand that it is the horse that pulls the cart; the whip hand belongs to the coachman.

Chinese negotiators have already made one colossal mistake in pricing their supply of liquefied natural gas (LNG). They are making a second in trying to draw out of Russia a discount for natural gas. For China to insist on tying Gazprom down to the extraction cost of Siberian gas - at a fraction of the price Gazprom sells its gas to Western Europe - is producing an impasse in current negotiations and slowing down Russia’s readiness to invest in the pipeline systems, on which Chinese calculations depend. ...

According to calculations by a Moscow gas market analyst, the share of natural gas in China's energy supply is expected to more than double to 7% by 2010 from the present 3%. In 2004, domestic natural gas production reached 47.5 billion cubic meters (bcm) in China. Consumption was at roughly the identical level, but is growing fast and is outpacing domestic extraction rates. The PRC's gas needs will amount to 97 bcm as early as this year and 103-120 bcm by 2010, according to conservative estimates. It is clear that gas imports are vital for China.

"Russian gas is the optimal and most mutually beneficial option to satisfy the PRC's increasing energy needs and hence the parties are interested in shortly achieving the targets stated in the Protocol," one analyst said. "From a commercial viewpoint, it is crucially important for Gazprom that gas will be supplied at prices formulated on the basis of petroleum prices. Certainly, there are some other benefits, including a relative proximity of consumers (the transmission route to China is far shorter than to Europe) and the absence of transit countries along the supply route."

The Chinese have been trying to come up with alternatives, and see if they add to leverage with Moscow and improve their bargaining position in the global market. The Russian conclusion is that they have thrown themselves a boomerang.

According to one industry source: "Take, for example, the LNG market - already this isn't working. Recent history shows that when China came to the LNG market to buy, everyone started pushing up the price. So the initial Chinese plan to buy everything on the LNG market raised the price, instead of holding it stable. The main suppliers for China now are Indonesia, Malaysia and Australia. But extraction in some of these countries will be falling. In others, pricing is tied to crude oil."

Gas traders claim that the Chinese at present find themselves signing to pay a premium to the prevailing crude oil price for LNG from the Middle East. A recent contract with Qatar sets a gas price equivalent to US$130 per barrel of crude oil. Freight costs come on top. Deliveries contracted from Australia in the Gorgon project (off the northwest coast of Western Australia) will not start until 2014, but they too are tied to oil. Chevron, ExxonMobil and Shell have signed forward agreements to share the product of Gorgon LNG between India, Japan and PetroChina. But supply to China will be limited to 1 million tonnes per annum, according to the heads of agreement signed last September.

If the crude oil price remains at the current level, then gas from these sources could cost China more than $500 per thousand cubic metres. That is roughly double the prevailing price at which Gazprom supplies gas to Europe.

Alternative supply schemes under consideration in Beijing include a pipeline from Myanmar, but the capacity is very small - just 10 bcm. Other pipeline routes from Turkmenistan and Iran are "a black box", the Russian source says. "The deposits are far from proven, and there are too many risks over too many borders, as the gas moves to China."