In my recent post on renewable energy I noted that production of biofuels had stalled, with production declining by 0.4% in 2012. Interesting ethanol production is declining while biodiesel production has doubled over the past 5 years and now accounts for 31% of the total.

Despite the recent plateau of production, the FAO is predicting ethanol production will increase by 67% over the next ten years with biodiesel increasing even faster but from a smaller base. By 2022, they project biofuel production will consume a significant amount of the total world production of sugar cane (28%), vegetable oils (15%) and coarse grains (12%).

The Economist recently had an article wondering "What happened to biofuels?", noting that production of first generation biofuels has stalled due to costs and the food vs fuel debate while advanced biofuels (such as cellulosic ethanol) have failed to appear in meaningful quantities so far - though commercial plants have started to appear - and that "flora vs fuel" may be the next battleground if they are produced successfully.

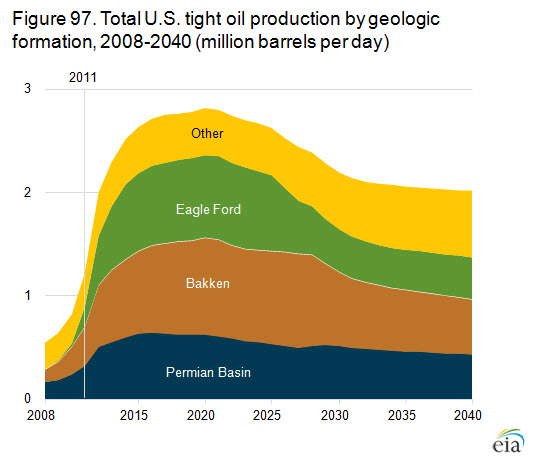

But instead of roaring into life, the biofuels industry stalled. Start-ups went bust, surviving companies scaled back their plans and, as prices of first-generation biofuels rose, consumer interest waned. The spread of fracking, meanwhile, unlocked new oil and gas reserves and provided an alternative path to energy independence. By 2012 America’s Environmental Protection Agency (EPA) had slashed the 2013 target for cellulosic biofuels to just 53m litres. What went wrong?

Making a second-generation biofuel means overcoming three challenges. The first is to break down woody cellulose and lignin polymers into simple plant sugars. The second is to convert those sugars into drop-in fuels to suit existing vehicles, via a thermochemical process (using catalysts, extreme temperatures and high pressures) or a biochemical process (using enzymes, natural or synthetic bacteria, or algae). The third and largest challenge is to find ways to do all this cheaply and on a large scale.

In 2008 Shell, an energy giant, was working on ten advanced biofuels projects. It has now shut most of them down, and none of those that remain is ready for commercialisation. “All the technologies we looked at worked,” says Matthew Tipper, Shell’s vice-president for alternative energy. “We could get each to produce fuels at a lab scale and a demonstration scale.” But bringing biofuels to market proved to be slower and more costly than expected.

The optimism of five years ago may have waned, but efforts to develop second-generation biofuels continue. Half a dozen companies are now putting the final touches to industrial-scale plants and several are already producing small quantities of second-generation biofuels. Some even claim to be making money doing so.

Consider Shell. Raizen, its joint venture with Cosan of Brazil, produces more than 2,000m litres of first-generation ethanol annually from sugarcane juice. Usually the fibrous stalks left over are burned for power or turned into paper, but next year Raizen will start turning them into second-generation bioethanol, using a cocktail of designer enzymes from Iogen, a Canadian biotechnology firm. Raizen hopes to produce 40m litres of cellulosic ethanol a year, cutting costs and boosting yield by co-locating its cellulosic operation with a traditional ethanol plant. Under this model, second-generation biofuels complement and enhance first-generation processes, rather than replacing them outright.

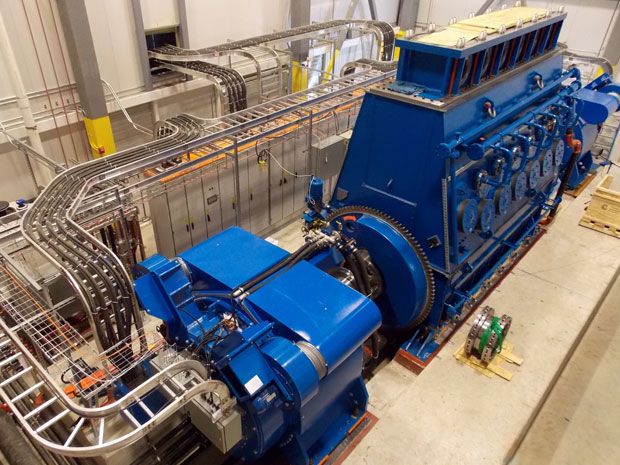

Three plants in America are expected to start producing cellulosic ethanol from waste corn cobs, leaves and husks in 2014: POET-DSM Advanced Biofuels (75m litres) and Dupont (110m litres), both in Iowa, and Abengoa (95m litres) in Kansas. But the first company to produce ethanol using enzymes on an industrial scale is Beta Renewables, a spin-off from Chemtex, an Italian chemical giant. An 80m-litre cellulosic ethanol plant in Crescentino, near Turin, has been running at half capacity over the summer, using straw from nearby farms. It will run on corn waste in the autumn, rice straw in the winter and then perennial eucalyptus in the spring. Beta Renewables has already licensed its technology for use in Brazil and Malaysia, and expects to sell several more licences by the end of the year. All Beta’s plants can already make biofuels at a profit, albeit only in areas with very cheap feedstocks, says the firm’s boss, Guido Ghisolfi. ...

Amyris, based in California, genetically engineers yeasts and other microbes to ferment sugar into a long-chain hydrocarbon molecule called farnesene. This can then be processed into a range of chemicals and fuels. After a few rocky years when it over-promised and under-delivered, Amyris is now producing limited quantities of renewable diesel for public buses in Brazil and is trying to get its renewable jet fuel certified for commercial use.

Solazyme, another firm based in California, is also focusing on renewable diesel and jet fuels, in its case derived from algae. Microscopic algae in open-air ponds can use natural sunlight and atmospheric or industrial-waste carbon dioxide to produce oils. But harvesting the fuel, which is present in only very small proportions, is expensive and difficult. Solazyme instead grows algae in sealed fermenting vessels with sugar as an energy source. The US Navy has used tens of thousands of litres of its algal fuels in exercises, and Propel, an American chain of filling stations, recently became the first to offer algal diesel. But although its technology clearly works, Solazyme remains cagey about the economics. A 110m-litre algae plant in Brazil, due to be up and running by the end of the year, may clarify Solazyme’s commercial potential. ...

Even if second-generation processes can be economically scaled up, however, that might in turn highlight a further problem. To make a significant dent in the 2,500m litres of conventional oil that American refineries churn through each day, biofuel factories would have to be able to get hold of a staggering quantity of feedstock. Mr Ghisolfi of Beta Renewables points out that a factory with an annual output of 140m litres needs 350,000 tonnes of biomass a year to operate. “There are only certain areas, in Brazil and some parts of the US and Asia, where you can locate this much biomass within a close radius,” says Mr Ghisolfi. “I am sceptical of scaling to ten times that size, because getting 3.5m tonnes of biomass to a single collection point is going to be a very big undertaking.”

Billions of tonnes of agricultural waste are produced worldwide each year, but such material is thinly spread, making it expensive to collect and transport. Moreover, farms use such waste to condition the soil, feed animals or burn for power. Diverting existing sources of wood to make biofuels will annoy builders and paper-makers, and planting fuel crops on undeveloped land is hardly without controversy: one man’s wasteland is another’s pristine ecosystem. Dozens of environmental groups have protested against the EPA’s recent decision to permit plantations of fast-growing giant reed for biofuels, calling it a noxious and highly invasive weed. Just as the food-versus-fuel argument has proved controversial for today’s biofuels, flora-versus-fuel could be an equally tough struggle for tomorrow’s.

On Earth magazine also has a look at the advanced biofuels story - Turning Grass into Gas, noting that the military, airlines and the bioplastic industry are all motivated customers.

When they failed to hit their mark, vultures circled the industry. In late 2011 a Wall Street Journal editorial branded it “The Cellulosic Ethanol Debacle.” Two early cellulosic companies, Calysta and Coskata, switched to making gasoline from natural gas. BP and Shell abandoned their cellulosic projects. Congress began reconsidering the value of the RFS, using the unmet cellulosic targets as Exhibit A. Stock prices of cellulosic companies tanked. Investment capital fled.

But then a funny thing happened: in early 2013, cellulosic ethanol refineries finally began producing biofuel. Texas-based KiOR, the nation’s leading independent cellulosic company, began shipping cellulosic diesel and gasoline from its refinery in Columbus, Mississippi. INEOS Bio’s Florida refinery began producing cellulosic ethanol from yard and wood waste in early summer. By 2014 the Spanish energy giant Abengoa, the chemical conglomerate DuPont, the ethanol maker Poet, and five other cellulosic refiners are expected to begin producing next-generation biofuel.

That production comes none too soon. Cellulosic refineries are expensive to build. A commercial-scale plant (producing about 20 million gallons a year) can cost $100 million to $200 million. Months of testing and tweaking are required before full production starts. The burn rate at cellulosic start-ups can be astronomical. Prior to its first fuel shipments this year, KiOR went through roughly $10 million a month on R&D; revenues were about $1,000 a day.

After six years of struggle, the cellulosic biofuel industry is finally taking its first steps toward self-sufficiency. “The good news,” Advanced Ethanol Council executive director Brooke Coleman told me, “is that in 2013 we’re expecting our production number for the first time to not be zero.”

If Coleman’s quote seems a little cockeyed, then you haven’t spent much time in the cellulosic biofuel space. When it comes to hope, mystery, controversy, and drama, no green energy sector can match it. Over the past six years, the industry has seen IPO jackpots and shocking failures, breakthrough discoveries and maddening delays. Some early believers have lost the faith in cellulosic. Others have found hope in the ability of cellulosic refineries to produce not just ethanol but also gasoline, diesel, jet fuel, and bio-based industrial chemicals, opening up new markets that might include the U.S. military, the global airline industry, and chemical manufacturers.

“Is cellulosic still worth it?” asks Mackinnon Lawrence, a renewable energy analyst and consultant for Navigant Research, in Colorado. “How much money do you throw at cellulosic to commercialize it? What’s its purpose now?”

These are fair questions. In a world of limited resources, it doesn’t make sense to pour money into failed technologies. It’s tough to know how the cellulosic story will end, or whether the grand ambitions of 2007 will ever be realized. Yet it’s clear that predictions of cellulosic’s demise have proved to be premature. ...

The companies that survive long enough to produce fuel may be the ones wealthy enough to give their chemists and engineers the time they need to work the bugs out of a technically demanding process. Of the four companies at or near commercial-scale production, three are sustained by deep-pocketed parents with revenue streams in other industries. What that money buys is time. Abengoa’s cellulosic plant in Hugoton, Kansas, a small town just north of the Oklahoma panhandle, is the company’s first commercial-scale biorefinery. “Frankly, we’ve been working on this process for 10 years,” said Chris Standlee, executive vice president of Abengoa Bioenergy, the company’s renewable fuel subsidiary. Abengoa started with “lab and pilot scale” facilities in Spain in 2003, he said, and the company has been working steadily on scaling up to larger plants ever since.

The curious thing about cellulosic biofuel is that even when production was zero, demand for the stuff continued to climb. It wasn’t all driven by the RFS mandate. Over the past few years, a number of companies and industries have set carbon reduction goals. It’s easy to become cynical about these announcements. But when they’re taken seriously they move markets—and provide critical demand for emerging green-fuel industries.

The American military is a huge future buyer. The U.S. Navy has announced that it wants to source half its non-nuclear fuel from renewables by 2020. That’s an ambitious goal, and the Navy is aggressively encouraging American biorefiners to build the plants necessary to produce upward of three billion gallons per year. Because the military is leery of the food-versus-fuel controversy, Navy fuel buyers are especially interested in advanced biofuels.

Pleasanton, California–based Fulcrum BioEnergy, which converts municipal solid waste into biofuel, has already signed development deals with both the Air Force and the Navy. Like most refiners, though, Fulcrum has yet to produce fuel: its Reno, Nevada, waste-to-fuel facility is still under construction.

Commercial airlines want cellulosic too. When officials from United, British Air, Lufthansa, and Qantas appeared before the advanced biofuels conference in Washington, the ballroom positively buzzed. The airline industry has a goal of becoming carbon neutral by 2020, and major carriers want cellulosic to be a big part of the fuel mix.

That market is massive. Worldwide, commercial airlines spend more than $200 billion a year on jet fuel, $50 billion in the United States alone. Airlines see carbon reduction as a key to their growth, because conventional fuels are expected to rise in cost as they become subject to carbon taxes and regulatory systems outside the United States.

“We expect to buy 100 million tons of biofuel by the year 2050,” Jonathan Counsell, head of environment for British Airways, told the conference.

No company is seeking biofuels more urgently than Qantas. Australia’s carbon tax has the airline paying more than $20 per emitted ton of carbon, so bringing more biofuel into their fuel mix isn’t merely a future concern. It’s a bottom line issue right now. And Australian companies are especially keen to find nonfood biofuels in light of the decade-long drought the continent suffered in the 2000s.

Another emerging market might prove nearly as valuable as marine diesel and aviation gas: renewable chemicals. The same process that turns switchgrass into ethanol can be tweaked to produce industrial chemicals such as BDO (1,4-butanediol) and butadiene, used in running shoes, cosmetics, tires, and other products. Earlier this year the German company BASF, the world’s largest chemical maker, signed a deal with San Diego–based Genomatica to produce renewable BDO using cellulosic technology. For BASF cellulosic chemicals could provide value at both ends of the factory: relief from the fluctuations of global petroleum prices and extra benefit to buyers. In competitive markets such as cosmetics and running shoes, bio-based ingredients could be the next wave of “organic” products.